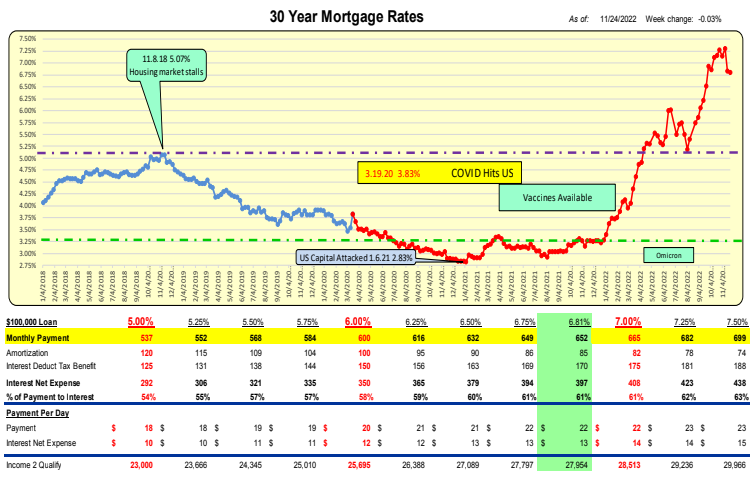

For the week ending 11.23.22 Mortgage rates DECREASED 3bp to 6.81%.

For a $100,000 loan the monthly payment DECREASED $3 to $654/mo or $.07/day.

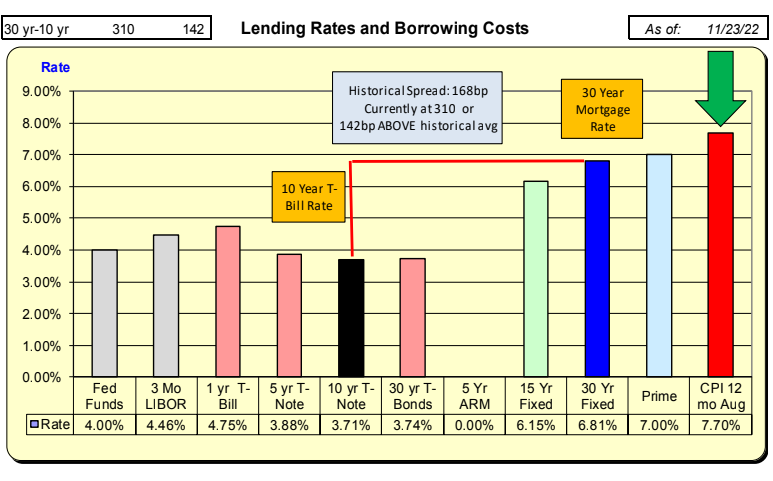

Lending Rates and Borrowing Costs

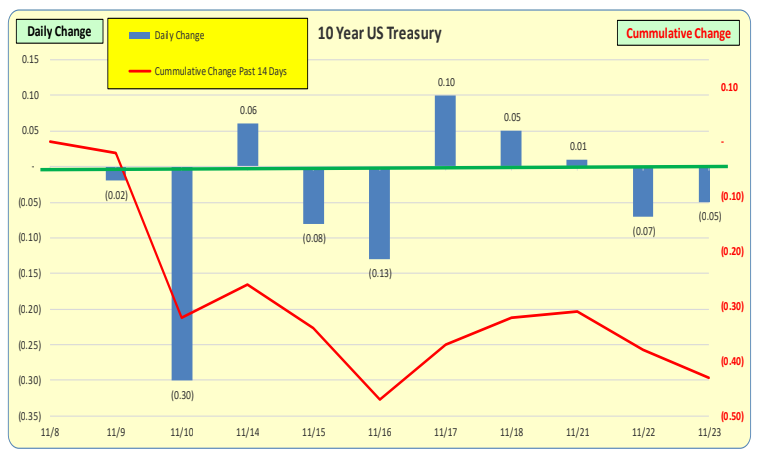

While mortgage rates DECREASED 3bp, 10 Year Treasury rates DECREASED 6bp. The net difference is a 3bp increase in a spread of 310bp. With the historical spread being 168 there now exists a “safety cushion” of 142bp above the historical spread.

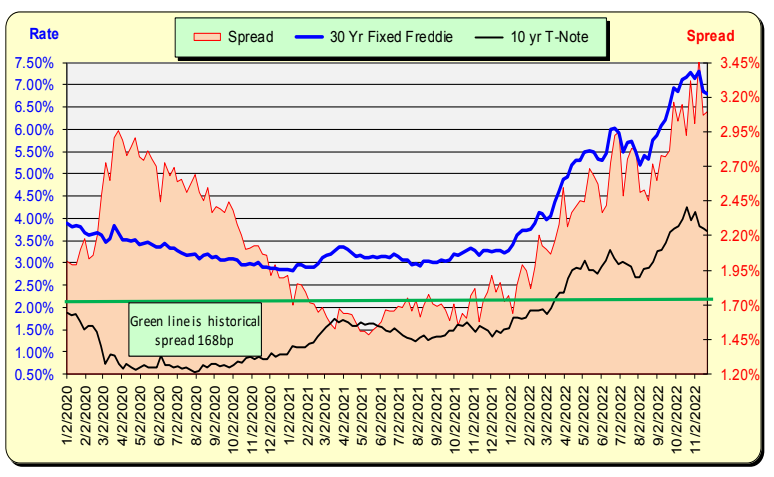

The historic spread between the 10 Year Treasury and mortgage rates is 168pb (see green line, right axis) and currently there is an 142bp above historical norm. For this spread to return to the historical norm, either mortgage rates will decrease further or 10 Year Treasury rates will increase.

Daily changes in the US 10 Year Treasury rates are the blue bars while the red line is the 14 day cumulative change in rates: <1bp> cumulative DECREASE. For the blue bars it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual. 30bp is beyond rare.

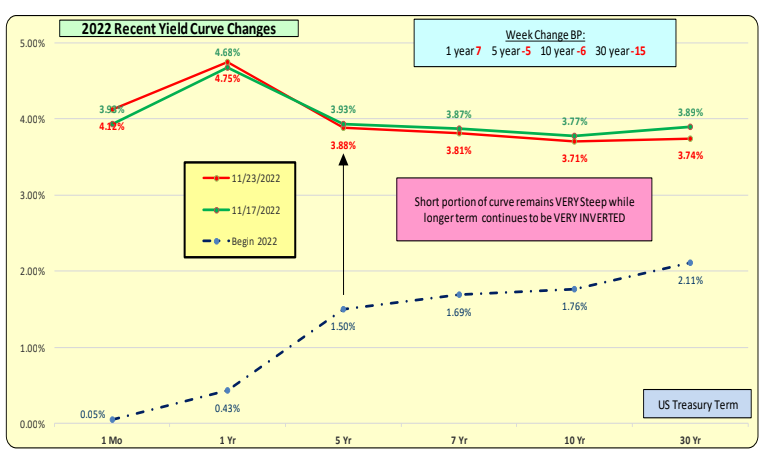

Red line is most current rates while the green line is one week ago.

Short term rates increased this week while long term decreased, this increased the yield curve’s inversion. The Yield Curve for middle terms decreased and the longer term (5+ years) remain INVERTED.