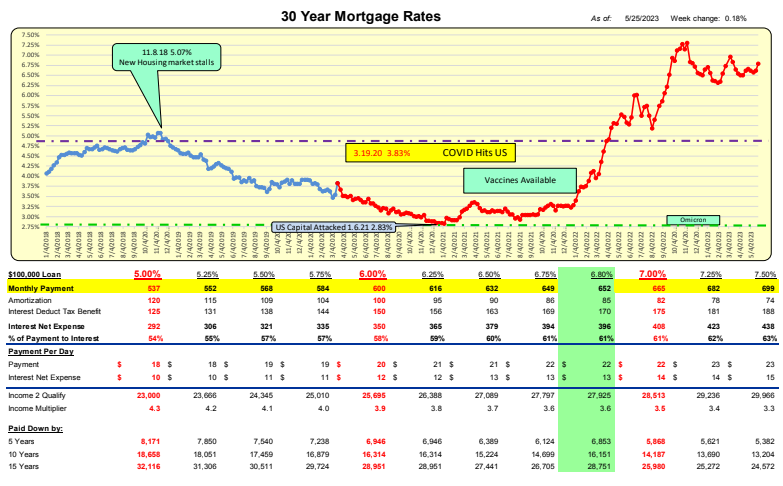

For the week ending 5.25.23 Mortgage rates increased 418bp to 680%. Since the middle of March, mortgage rates had been in a tight range between 6.50% to 6.65%. SVB bank went under March 10. For a $100,000 loan the monthly payment increased $12 to $652/mo or $0.40/day.

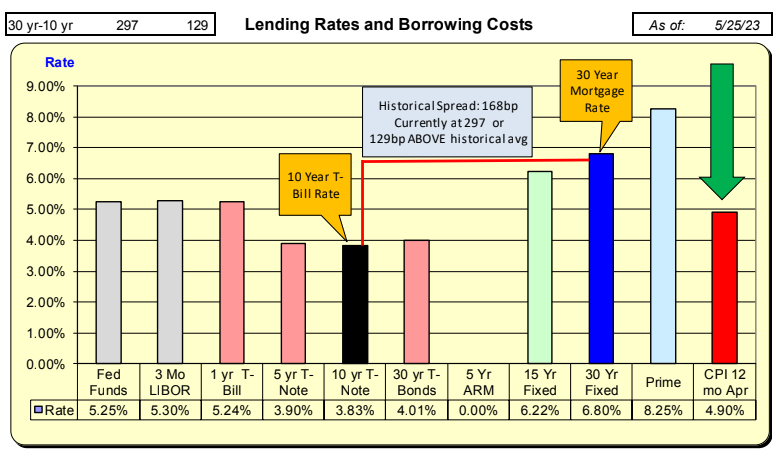

While mortgage rates increased 18bp and 10 Year Treasury rates also increased 18bp. This increase was spread over multiple days in small increments. The net difference resulted in zero change in the spread to 297bp. With the historical spread being 168 there, now exists a “safety cushion” of 129bp above the historical spread.

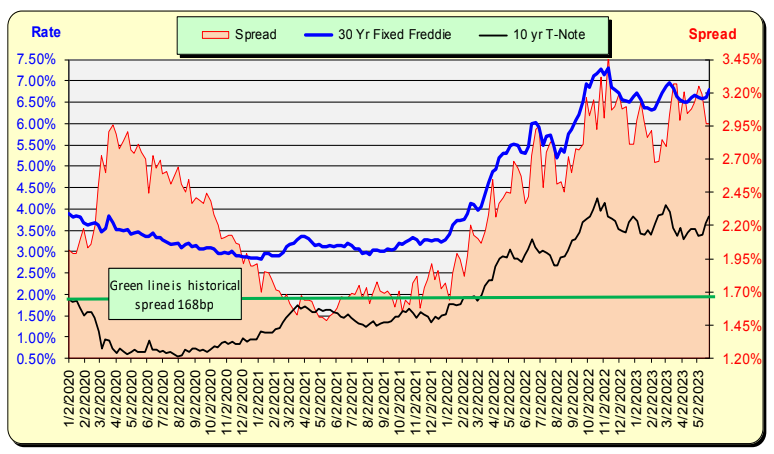

The historic spread between the 10 Year Treasury and mortgage rates is 168pb (see green line, right axis) and currently there is an 129bp above historical norm. For this spread to return to the historical norm, either mortgage rates will decrease or 10 Year Treasury rates will increase. Treasuries increased 18bp this past week (prior week was 26bp).

Bill Knudson, Research Analyst LANDCO ARESC