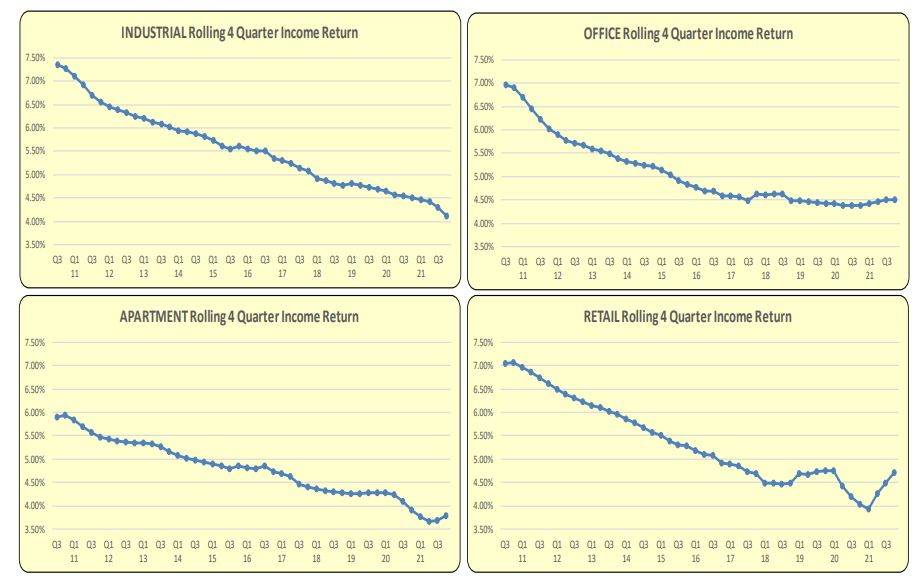

The National Council of Real Estate Investment Fiduciaries (NCREIF) shows rolling 4 Quarter Income Returns for all 4 property types (industrial, apartment, office, and retail) at near-record lows. This implies cap rates are also near record lows.

US 10 Year Treasury Rate and Rolling 4 Quarter Income Returns have a high correlation. Property returns in essence are risk-based relative to the US Treasury 10-year rates. Should the 10-year rates rise, cap rates will follow which will have an adverse impact on property values.

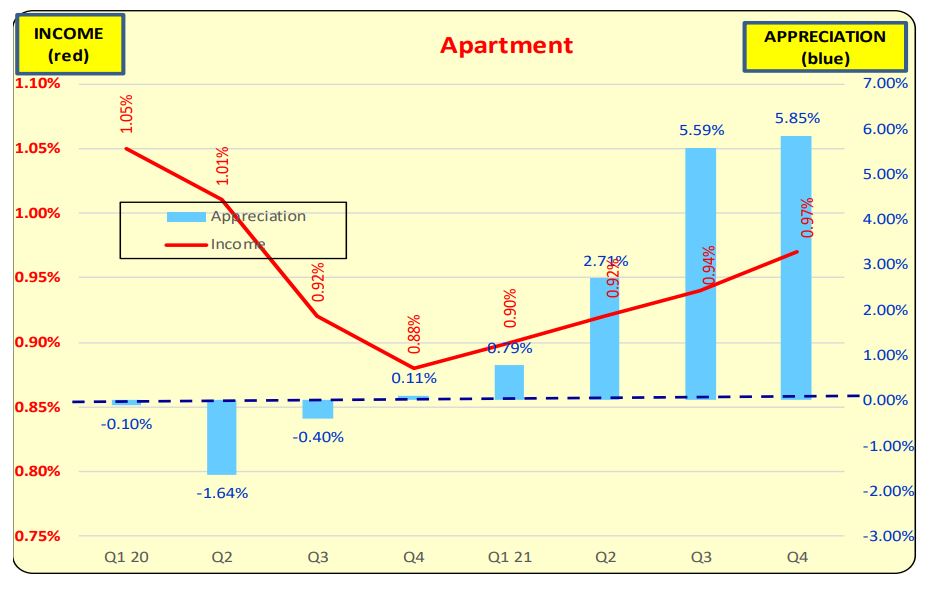

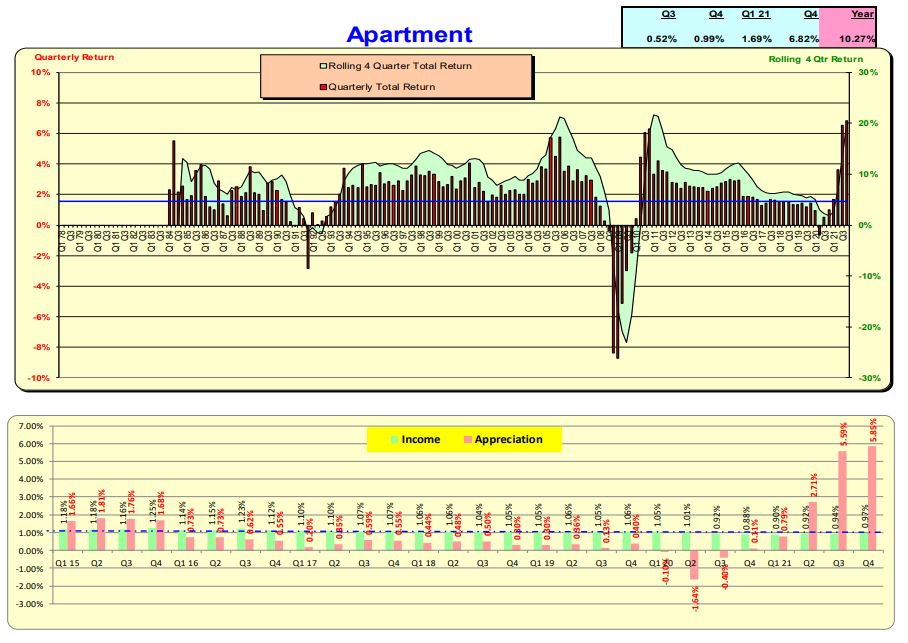

As seen in the following graphs, Apartment income returns bottom out in Q4 and have risen since. Appreciation returns have followed a similar pattern driving APPRECIATION RETURNS to record highs.

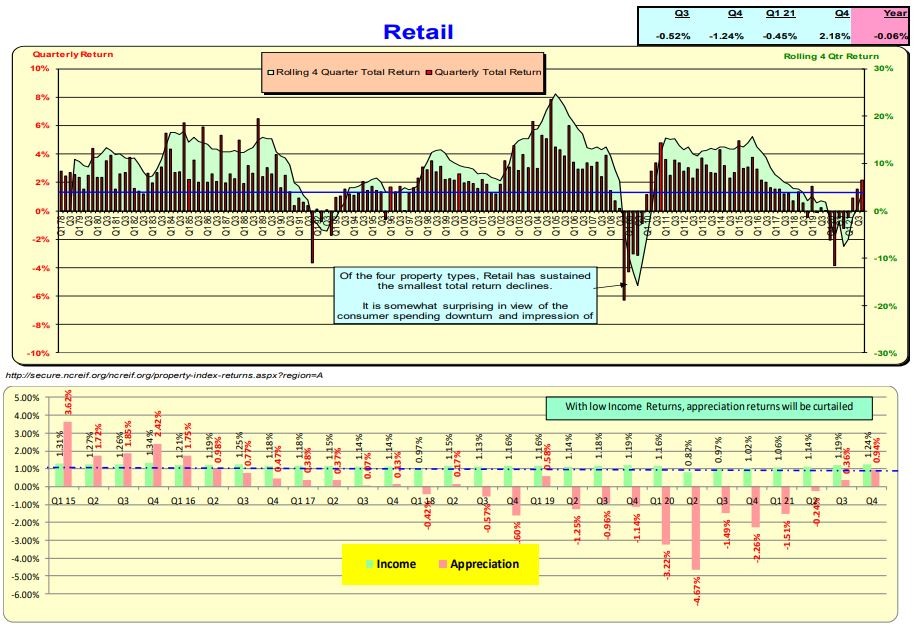

Income returns have been slowly increasing on retail property and appreciation has likewise increased.