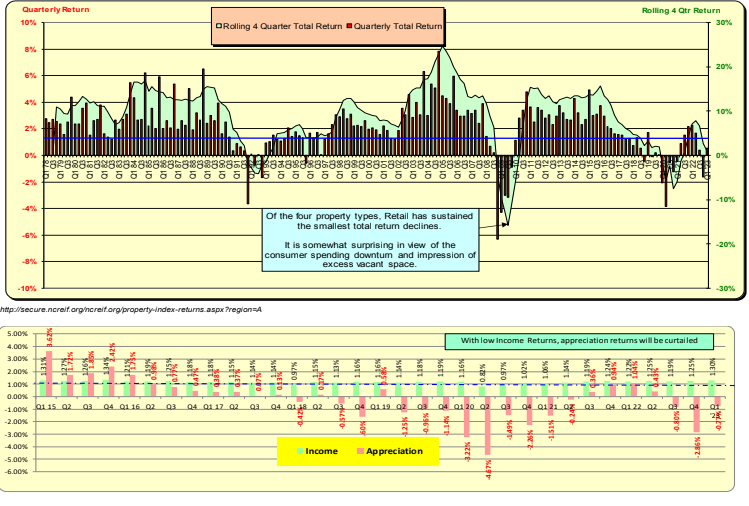

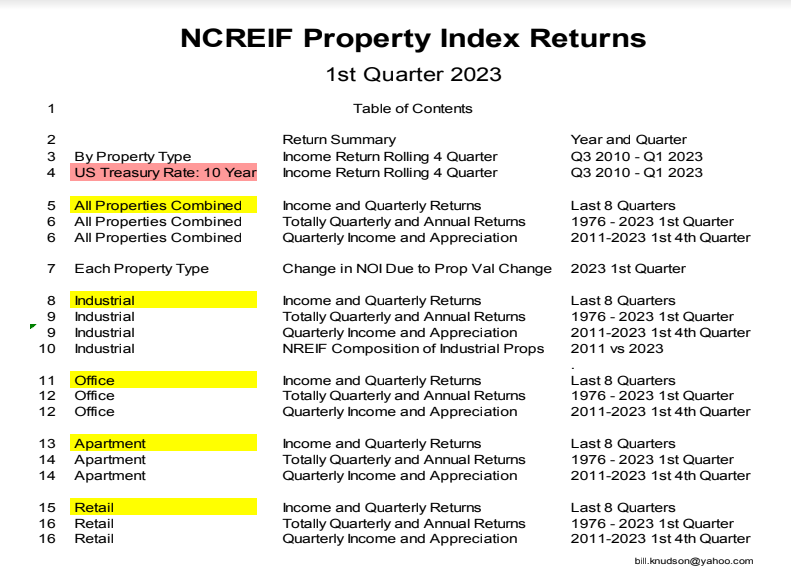

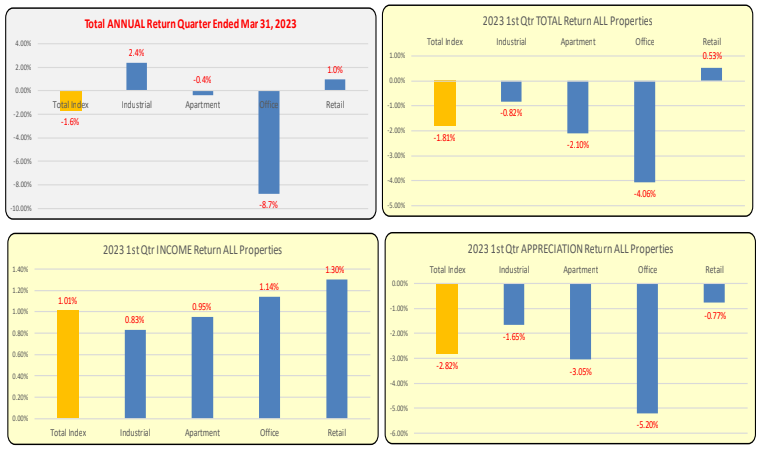

For the past 4 quarters, only industrial and retail properties eked out a positive total return. Retail was the only property type that had a positive return in the 1st quarter of 2023. However, In Q1, all properties had negative appreciation returns, reflecting the changes in cap rates as CRE pricing adjusts to a higher interest rates environment. Industrial properties continue to have the lowest Income Return, which is near its lowest level ever.

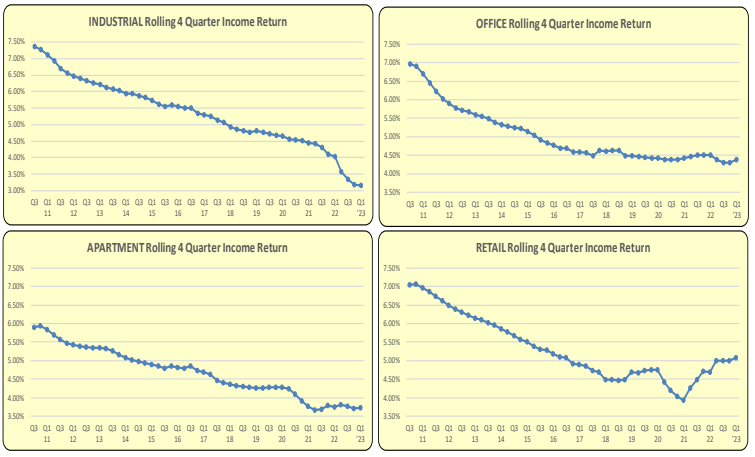

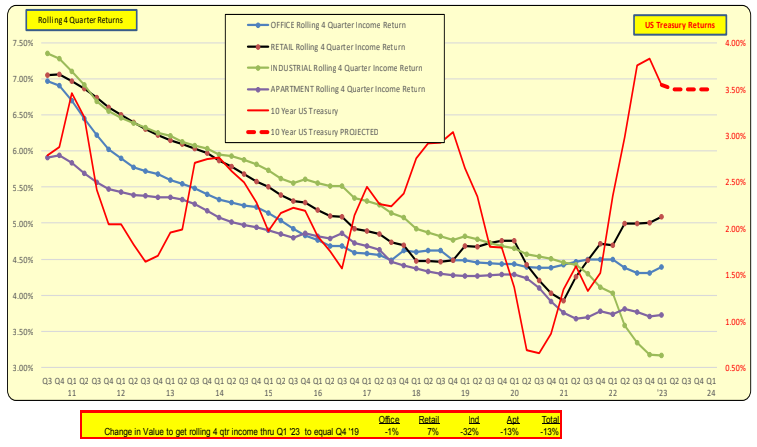

The rolling 4-quarter income returns for three out of four property types are near record lows, implying that cap rates are also near record lows. Even with the property value write-downs in the 1st quarter, income returns were not materially changed. The key issue is whether NOI returns are being driven by property write-downs or actual increases in NOI.

The US 10-Year Treasury Rate and rolling four-quarter income returns have a strong correlation. Property returns, in essence, are risk-based relative to the US Treasury 10-year rates, which saw a significant increase starting in Q2 2022. The dashed red line represents projected rates into Q4 2024 based on the most current Fed’s ‘dot plot’ and the inverted yield curve’s 10-Year Treasury spread. This increase will have a significant and adverse impact on both income and appreciation returns going forward.

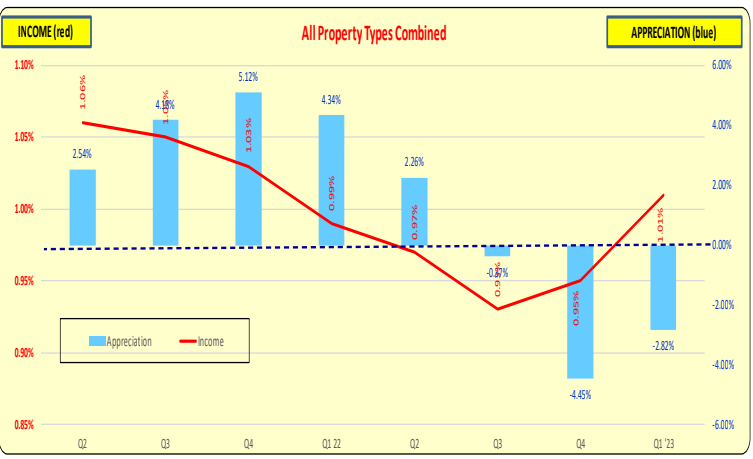

Regarding all property types combined, income returns increased slightly in Q1 as property appreciation was negative. The low income returns are concerning due to the rise in competing benchmark asset classes. The appreciation returns remained negative in Q1 and dropped by 2.82 points in Q1 2023.

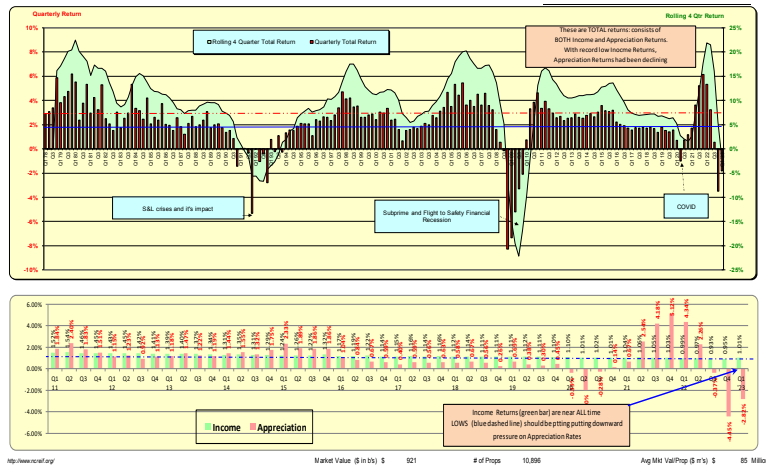

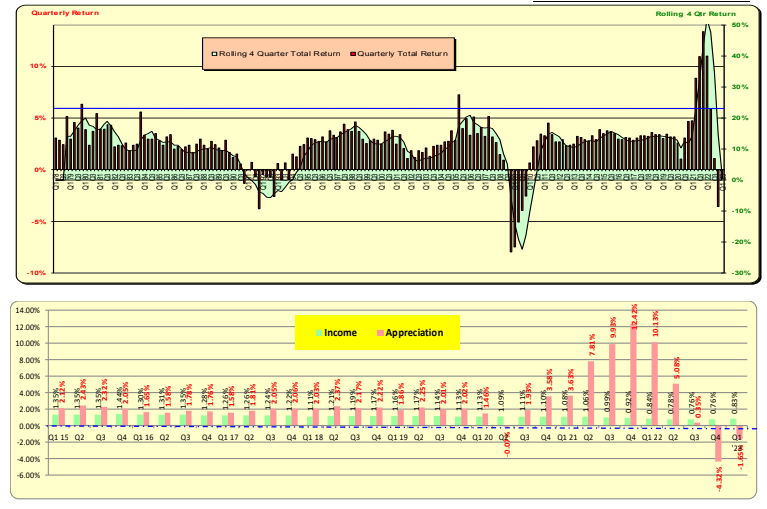

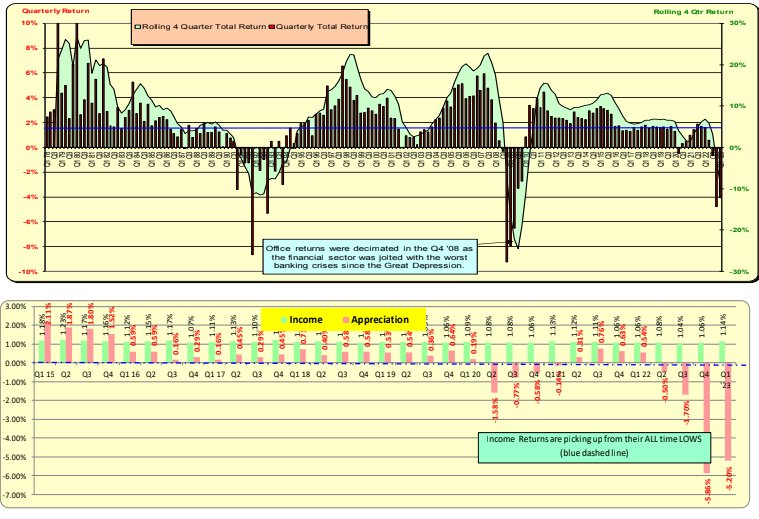

ALL PROPERTIES COMBINED: Annual return went negative in Q4 and WILL continue to do so into the future as prior quarters with high returns drop off. Total returns were driven by INDUSTRIAL properties but even this property type’s returns have gone negative in Q4. Note in the lower graphic that quarterly income returns remain near record lows.

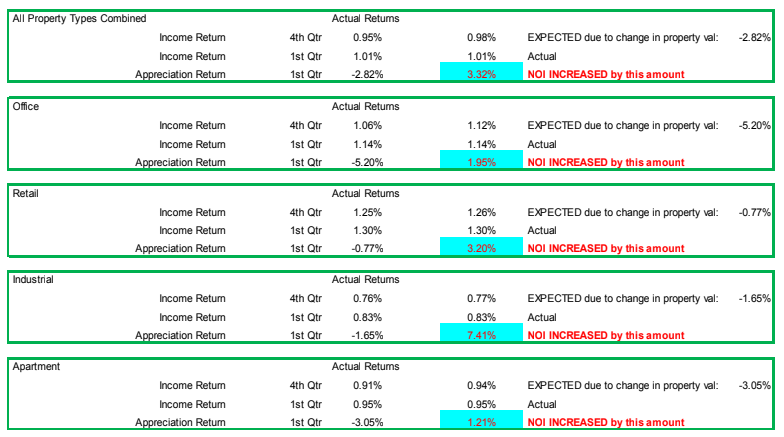

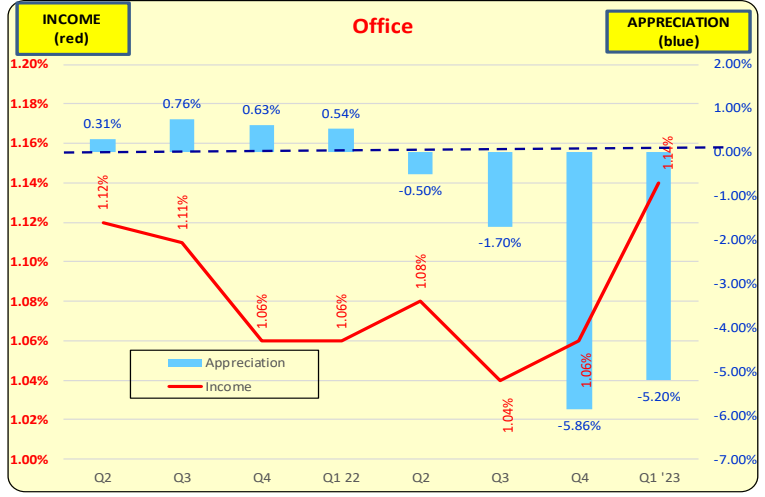

In terms of NOI growth due to property devaluation vs. NOI increase, the NOI actually increased in each of the four property types above and beyond property write-downs. Industrial properties saw a 1.65% decrease in property value, but the NOI return increased due to a 7.4% increase in NOI return between 4Q and 1Q. For office properties, the NOI increased by 1.95%. Given that the NOI return is 1.06%, a 1.95% increase in NOI equals approximately 2bp in NOI return. To go from 1.06% to a desired 1.16% return will take five quarters provided there are no property write-downs. However, the 11% write-downs in Q4 and Q1 pushed the NOI return to 1.14%.

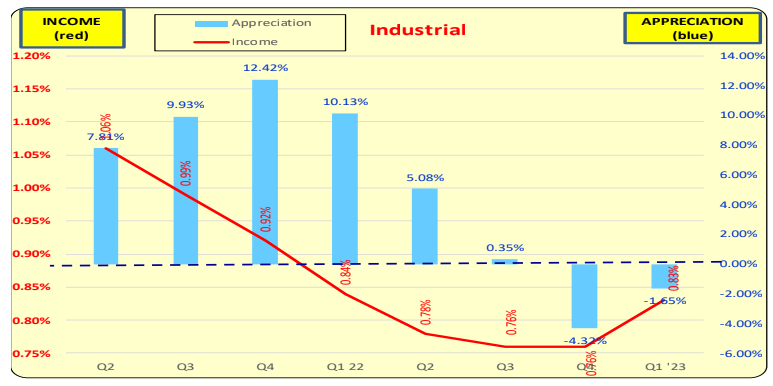

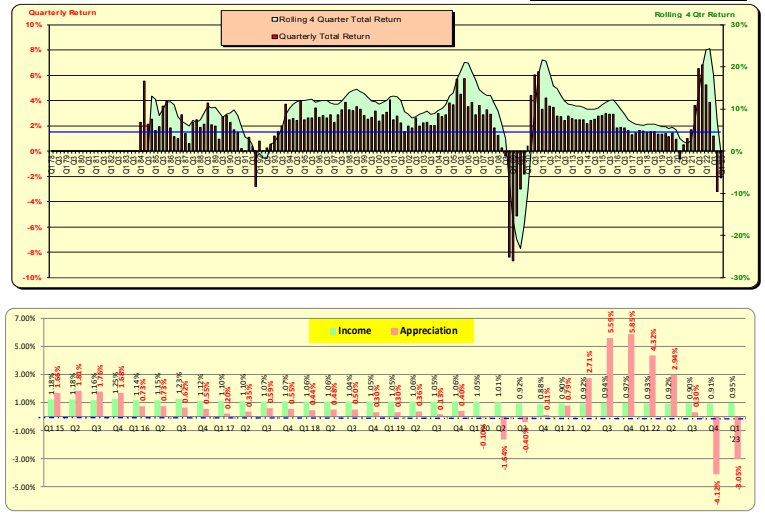

In terms of INDUSTRIAL properties, total returns were previously driven by record-shattering appreciation returns. However, income returns have been decreasing, which could indicate anticipated future income increases or decreases in CAP RATES. The rising 10 Year Treasury rates raise concerns about whether the lower cap rates can be sustained. During the COVID outbreak from 2020-2022, there was an increase in demand for industrial properties due to people staying at home and shopping online. However, with COVID becoming less of a public policy issue, it remains to be seen whether the online shopping trend will remain at high levels.

The record returns for INDUSTRIAL properties are over. Income returns are at record lows, which is the lowest of any property type that I can recall. Appreciation is dropping off fast, and that will pull down the total returns.

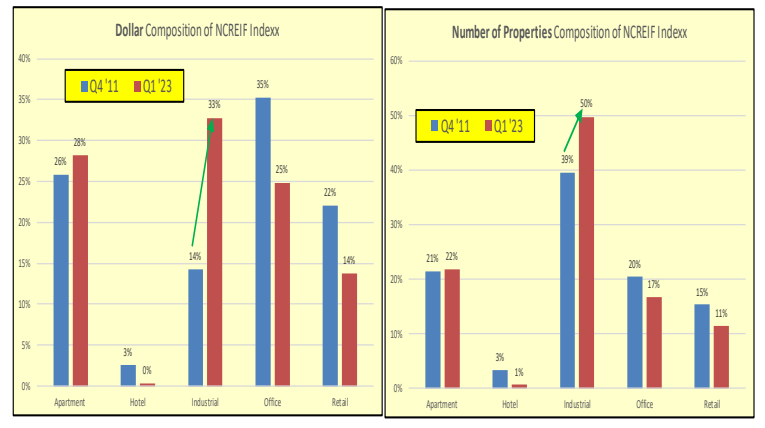

INDUSTRIAL PROPERTIES as a % of NCREIF: NCREIF’s composition by property type changes gradually over time. The table below shows the changes from Q4 2011 to Q1 2023, during which there has been a significant increase in Industrial Properties. This change in composition has led to higher total NCREIF returns due to record-breaking industrial property returns. However, be cautious of the record-low income returns for Industrial Properties.

OFFICE: Income returns increased in Q1 driven by the quarter’s negative appreciation of 11% over the past 2 quarters.

OFFICE: COVID induced demand drop, rising 10 year Treasury rates, recession—not looking good for office. Income returns are no longer near the all time lows due to the property write downs.

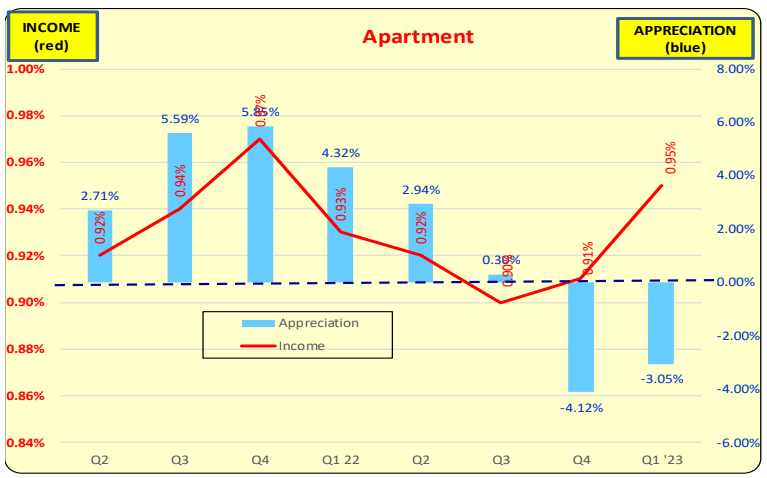

APARTMENT: Income returns have increased due to a 7% decrease in property values during Q4 and Q1.

APARTMENT: Total annual returns will fall off FAST as prior high quarter returns are not maintained.

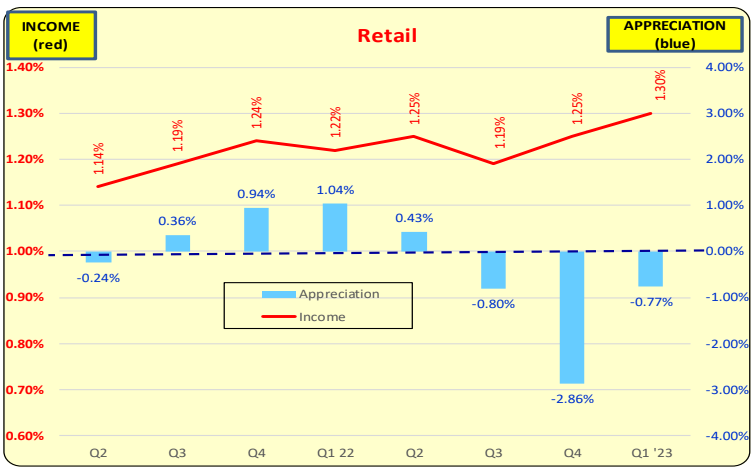

RETAIL: Income return had been slowly increasing. The Q1 increase in income returns was helped partially by the decline in property values for Q4 and Q1.

RETAIL: COVID was NOT good to retail which is very slowly recovering. Retail properties did not have valuation spikes during the COVID time periods.