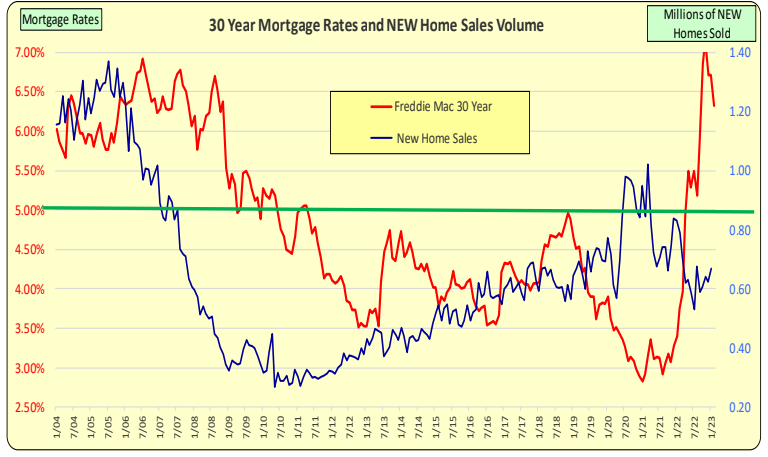

COVID started in March 2020 and Mortgage rates declined to record lows of 3.00% between Oct 2020 thruFeb 2021. This brought forward demand and thus lessened demand in later months.

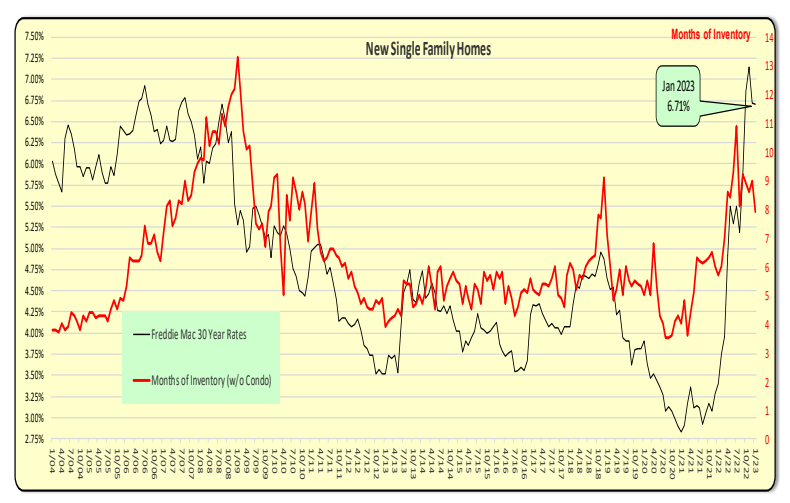

In November 2018 mortgage rates reached 5.00% and NEW home sales materially decreased. In March2022 mortgage rates materially increased and breached 5.00% and sales immediately declined.

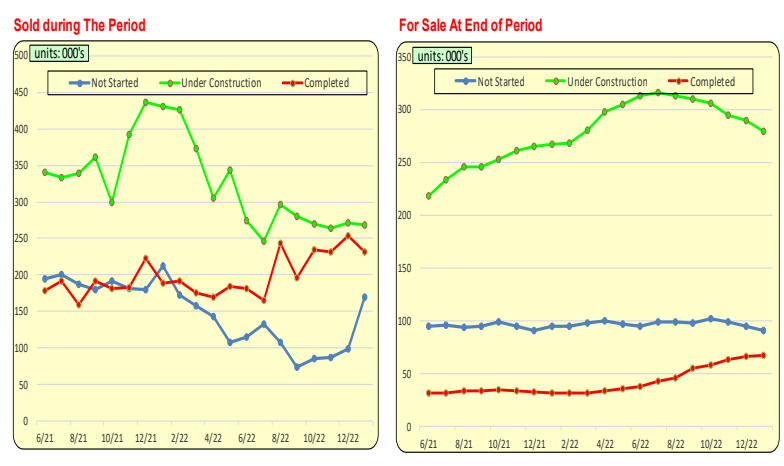

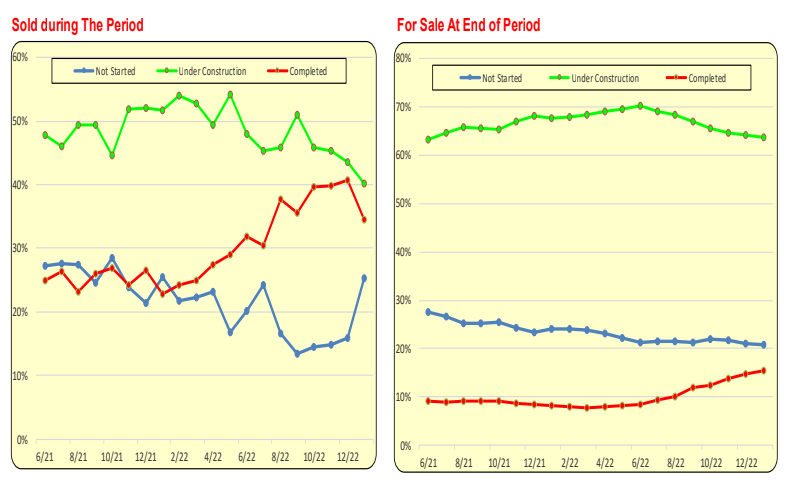

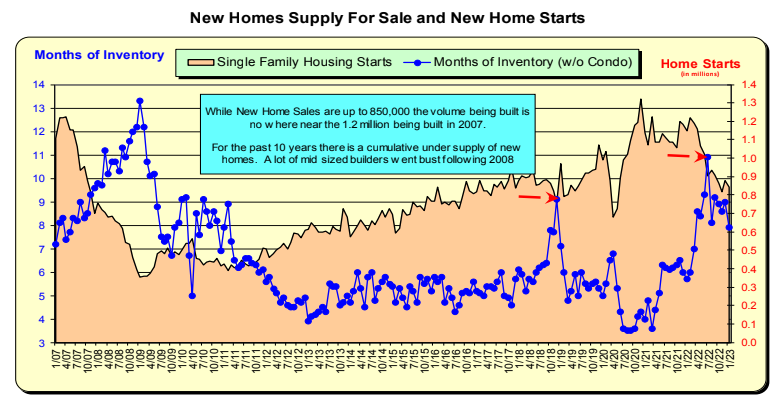

Homes under construction are either sold prior to completion or they are completed and move to completed unsold homes for sale. The number of completed homes for sale is gradually rising which would indicate a backing up of inventory. The number of homes under construction for sale is decreasing and this will slow the increase in completed, unsold homes.

Over the past 6 months 45% of the NEW homes sold were homes were under construction while 30% were completed homes. A key metric to monitor is the red line in the lower right corner: completed homes for sale at the end of the period. If that rises, it implies excess inventory is occurring.

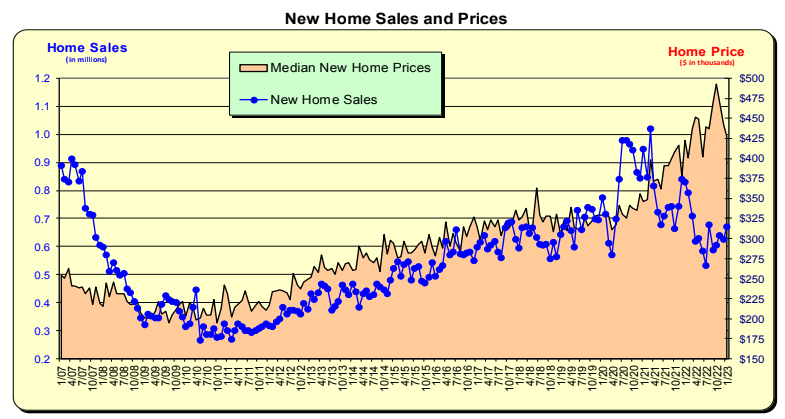

In the past, when mortgage rates increased, sales of new homes have slowed causing the New Home Sale’s Months of Inventory to spike. Note the mortgage rate spikes in Nov 2018 and April 2022—which exceeded 5.00% this is a major price point for Millennials. The runup in rates in 2022 are unprecedented as the Fed fights inflation. Rates had increased to 7.15% as of the 1st of November. In Feb they decreased to 6.30%.

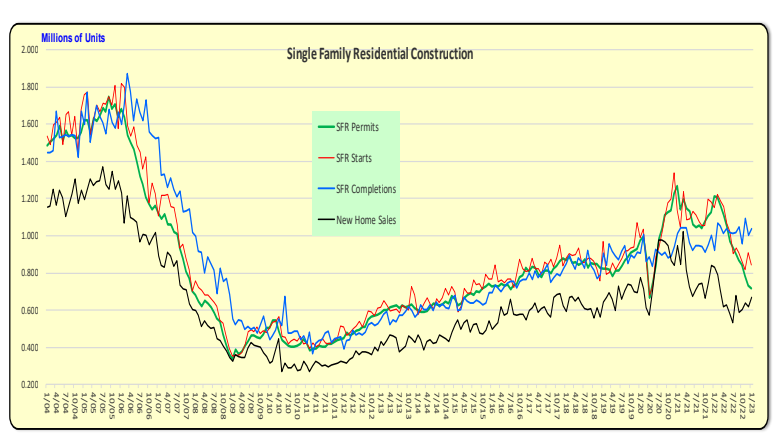

NEW home Permits, Starts and Completions reveal how home builders have pulled back on new construction and are completing homes under construction. The blue line will decrease in the future.

Recent decreases in Permits and Starts will lead to future decreases in Completions. A key metric to watch is how fast will completions slow relative to sales. With fewer completions, sales will decrease.

NEW home months of inventory is slowly declining as the market adjusts to higher mortgage rates.

When COVID first appeared in the US, new home sales initially dropped and then sharply rebounded as mortgage rates hit multi generation lows of 3.00%. With a sudden surge in sales, months of inventory dropped (blue line). When mortgage rates rose in early 2021, sales pulled back and months of inventory returned to levels that prevailed prior to COVID It is important to note the large increase in Months of Inventory which occurred in November 2018. That is when Mortgage rates reached 5.00% and sales slumped. On April 14, 2022 rates exceeded 5.00%.

Bill Knudson, Research Analyst LANDCO ARESC