Existing homes Sales continue to pull back due to record low available homes for sale and due to increasing interest rates.

Rising mortgage rates will slow future home sales but in the immediate short run, there is a rush to buy as near-term home buyers rush into the market to purchase BEFORE mortgage rates rise further.

Historically, 75% of any home price appreciation for a calendar year will occur in the 2nd quarter. Home closings rise in the 3rd quarter.

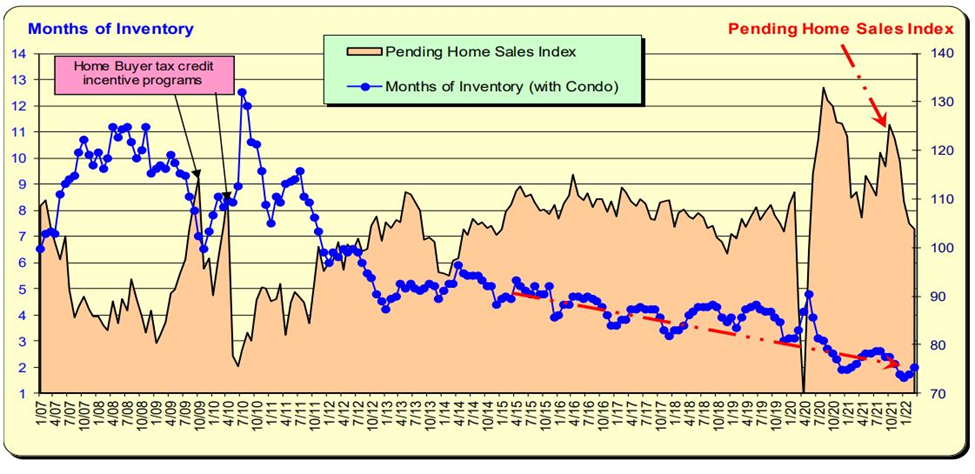

When increases in mortgage rates start to have an adverse impact on home sales, the Months of Inventory of homes for sale will increase. Note how the has materially dropped off—initially due to lack of available homes for sale and more recently due to increasing mortgage rates.

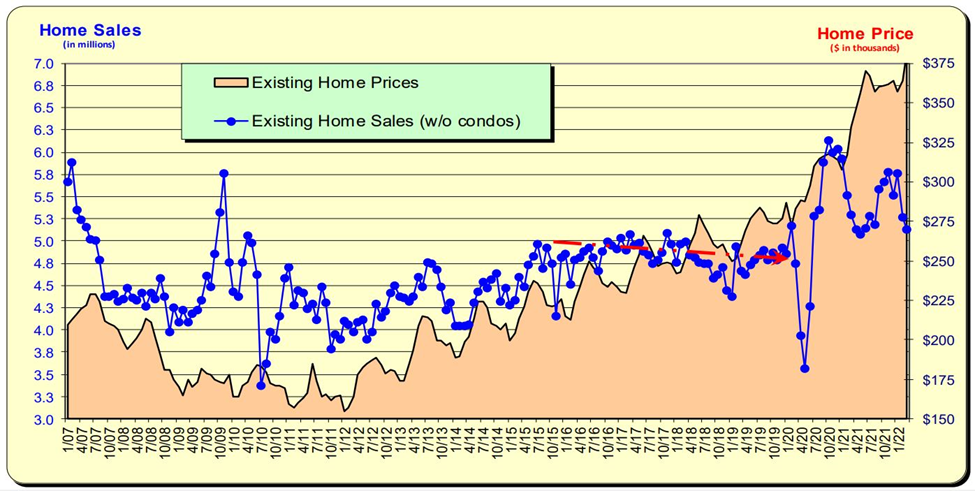

Existing Home Sales and Prices

Since Sept 2021 the number of EXISTING home sales has decreased as mortgage rates hovered in the 3.25%-3.75% range and materially dropped off in February/March 2022 as rates headed towards 5.0%. Existing home prices picked up in March 2022—attributed to a lack of homes for sale and the rush to buy as mortgage rates increased in March and April.

Mortgage Rate & Home Sales

Mortgage rates are now above 5.00% (red line below) and it is anticipated that this will have a dampening effect on home sales. (blue line) Home prices are the dashed green line and even with mortgage rates rising, home prices rose. This has occurred in the past when rates rose—-future near-term home buyers rushed into the market to buy now before mortgage rates rose. The black line represents the change in prices from June 2021 to March 2022.

Existing Homes Supply For Sale and Pending Sale Index

Existing Home Months of Inventory remains near record lows. Mortgage rate increases will impact sales volume and the months of inventory will rise. Pending Home Sales Index has materially decreased over the past 6 months—initially due to a lack of homes for sale AND now rising mortgage rates.

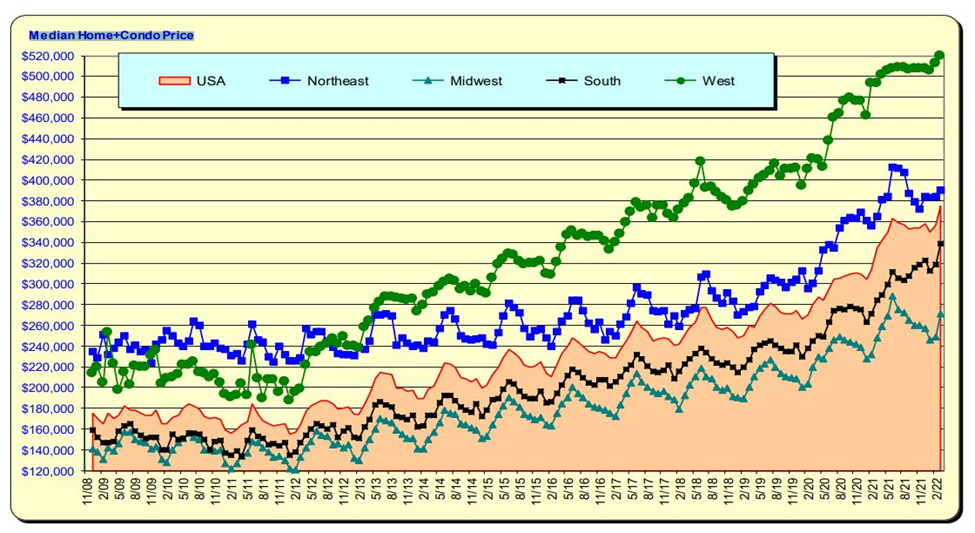

Median Home + Condo Price

Median home prices in the Western and Northeast regions have leveled off while they have risen in the South and Midwestern regions. April 2022 data will be reported on May 19th. The 12-month year-over-year price appreciation for the West will be near zero. The flatlining of prices will be attributed to the Mortgage rate increases starting in March 2022 even though the price slow down had started months earlier in April 2021.

Bill Knudson – Research Analyst for Landco ARESC