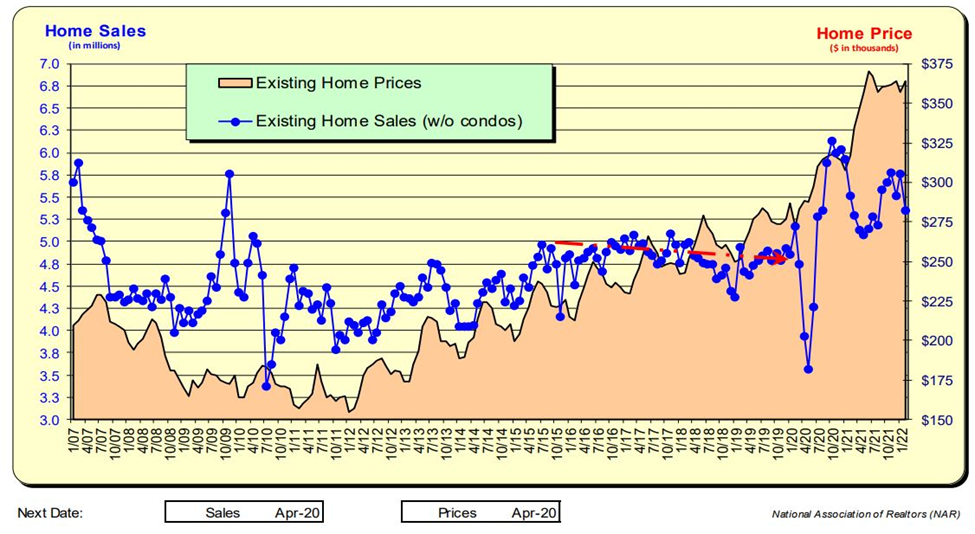

Existing homes, Sales, and Price Appreciation over the past 8 months have been relatively flat and that is BEFORE the Impacts of the Mortgage Rate spikes of March and April 2022. Unless home price appreciation occurs over the next 4 months, Existing home prices are going to be minimal if not slightly negative as measured year over year.

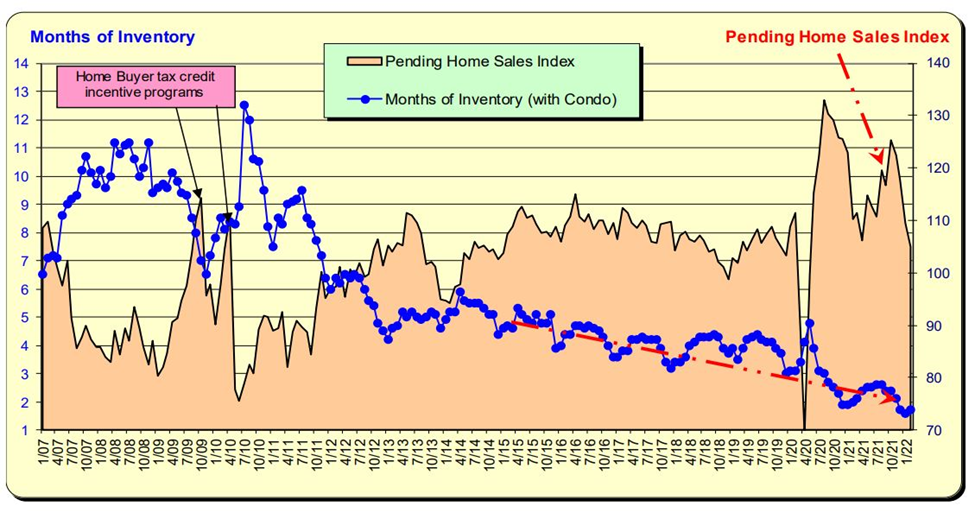

For each home sold, that seller becomes tomorrow’s home purchaser. Higher home prices and rising interest rates can lead to reduced future home sales as existing homeowners stay put. Should this occur, a downturn in the Pending Sales Index (brown shaded area) should be a leading indicator of this event.

Existing home sales outnumber New home sales by 8:1. Existing home sales volume impact retailers and their supplies such as Home Depot, Lowes, and home furnishing stores. New home construction is a major driver of employment/jobs plus the sales of materials needed for the construction of a new home.

Existing Home Sales and Prices

Since Sept 2021 the number of EXISTING home sales has gone flat as mortgage rates hovered in the 3.25%-3.75% rate and materially dropped off in February 2022 as rates went above 4.0%. Overall sales remain substantially above the level that prevailed prior to COVID-19. When COVID-19 first hit in March, sales plummeted but soon spiked to record levels in the following months. It is worth noting, Existing home prices reached record levels in June 2021.

Mortgage Rates & Home Sales

The last time mortgage rates were 5.00% was November 2018 (red line below). As rates decreased the number of Existing homes sold increased (blue line) Mortgage rates went to multi-generation lows of under 3.00%, and both sales and prices accelerated. This one-time event where rates were under 3% was 17 weeks As rates started to rise in spring 2021, sales pulled back and home prices peaked in June 2021 and have leveled off. The black line represents a 12-month annual change, note how the upward is slow. If prices continue to be flat, the black line will level off, thus leaving the impression that housing has slowed. This realization will occur in July/August 2022.

Existing Homes Supply For Sale and Pending Sale Index

Existing home months of inventory have been steadily decreasing since 2011 with a consistent seasonal component of decreases in Dec/Jan. Months of inventory are at all-time lows. With such lows, one would anticipate higher home prices, but sales have tapered off with higher interest rates. Following the adverse impact of COVID in March 2020, Pending Home Sales Index has remained at record high levels although in recent months is down due to a lack of homes for sale AND rising mortgage rates.

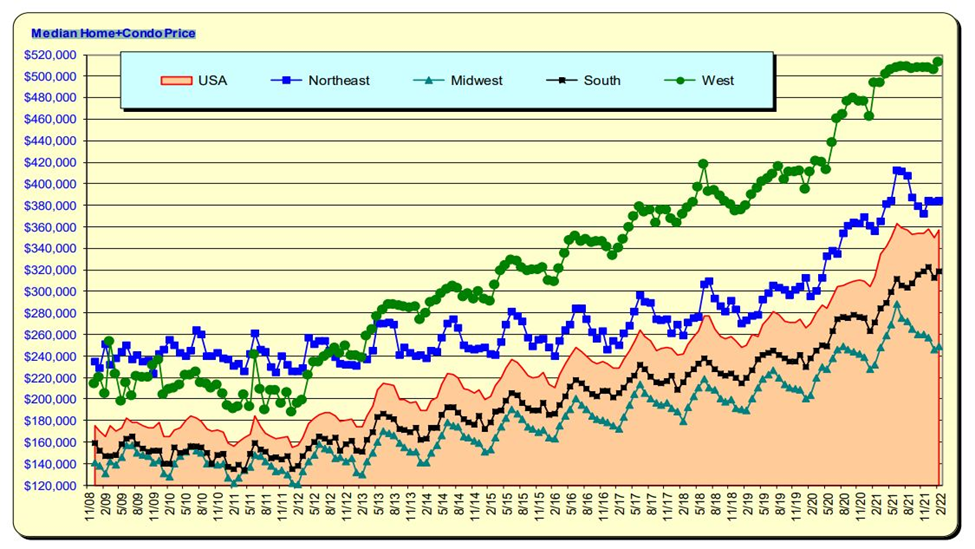

Median Home + Condo Price

Home sales by region in the country have varied. In April 2021 the median home price in Western region went over $500,000. Since that time period, prices have remained flat going on a year. April 2022 data will be reported on May 19. The 12 month year-over-year price appreciation for the West will be near zero. The flat lining of prices will be attributed to the Mortgage rate increases starting in March 2022 even though the price slow down started months earlier in April 2021.

Bill Knudson – Research Analyst for Landco ARESC