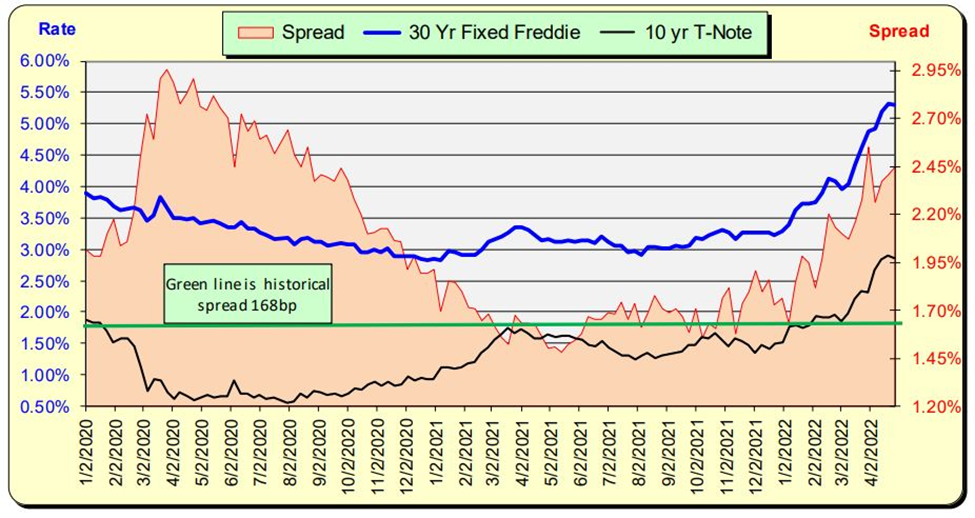

Mortgages rates decreased 1 basis point (bps) while the 10 Year US Treasuries were down 5 bps, thus the spread increased 4 bps to 245 bps or 77 bps ABOVE the 168 bps average. The mortgage market is pricing in future rate increases by the Fed.

The next Fed meeting is this coming Wednesday MAY 4, just 5 days away. Do NOT be surprised if they raise the Fed Funds rate by 50 basis points.

30 Year Mortgage Rates

MORTGAGE RATES ARE NOW WELL ABOVE 5.00% and decreased 1 bps to 5.30%. For a $100,000 loan, the monthly payment decreased by $1 to $555 which is equal to $0.02 a day.

Rate vs. Spread

Rates rocket up and feather down. The historic spread (aka difference) between the 10 Year Treasury and mortgage rates is 168 bps (see green line) At the start of 2022 mortgage rates have increased FASTER than the 10-year Treasury. This past week the 10 Year decreased by 5 bps while Mortgage rates decreased 1bp thus their spread increased by 4 and now stands at 77 bps above the historical norm.

Bill Knudson, Research Analyst Landco ARESC