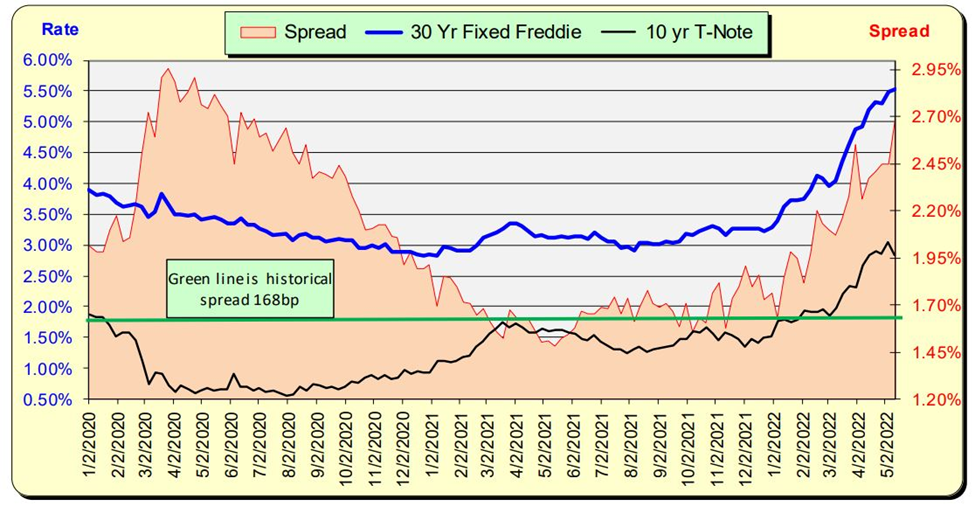

Mortgage rates increased 3 basis points while 10 Year US Treasuries decreased by 21 bps, thus spread increased by 24 bps to 269 bps or 101 bps ABOVE the 168 bps average.

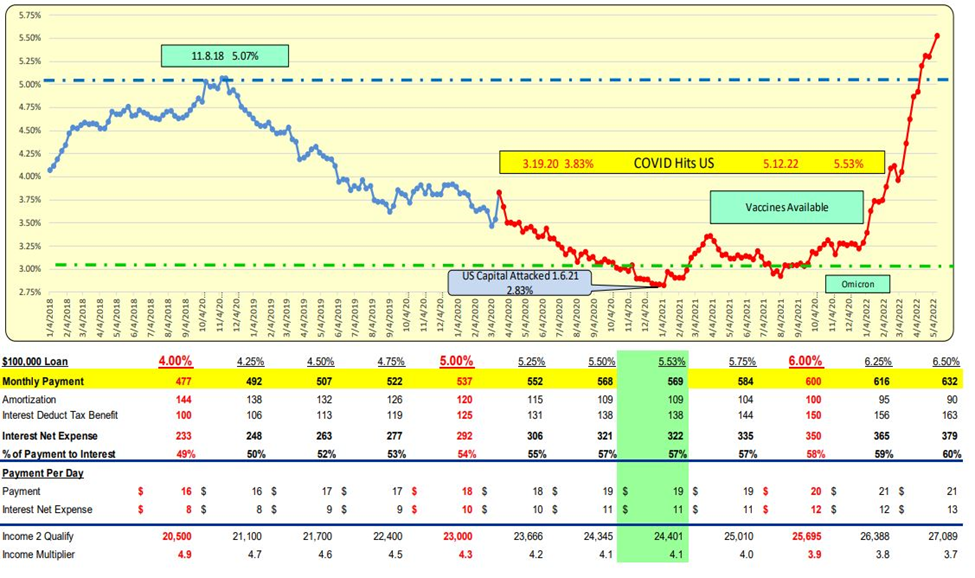

A 3-bps increase is a $2 a month payment increase for a $100,000 loan. That is a $0.06 (six cents) a day increase. Rates are virtually unchanged.

Keep in mind at the May 4th Federal Reserve meeting increased the Fed Funds rate by 50 bps.

Pricing folks will be running scared given how fast rates have soared lately and will likely NOT want to give up that 101bp cushion any time soon.

Therefore, mortgage rates will NOT be inclined to lower in response to the 10-year Treasury 21bp decline. This is part of the reason why rates feather down but rocket up. The pricing guy cannot raise rates fast enough in a rising rate environment but are afraid to drop them in a declining market—hence the feather down.

30-year Mortgage Rates

For the week ending 5.12.22 Mortgage rates barely increased 3bp to 5.53%. For a $100,000 loan, the monthly payment increased by $2 to $569 which is equal to $0.06 a day.

Rate VS Spread

Rates rocket up and feather down. The historic spread (aka difference) between the 10 Year Treasury and mortgage rates is 168 bps (see green the line). At the start of 2022, mortgage rates have increased FASTER than the 10-year Treasury rates. This past week the 10 Year treasuries decreased 21 bps while Mortgage rates increased 3 bps thus a 24 bps change in spread remains at 101 bps above the historical norm. That is a large spread but given how quickly rates have recently risen, pricing personnel is going to want to “hold onto this cushion” to be safe against unexpected rate increases.

Bill Knudson, Research Analyst Landco ARESC