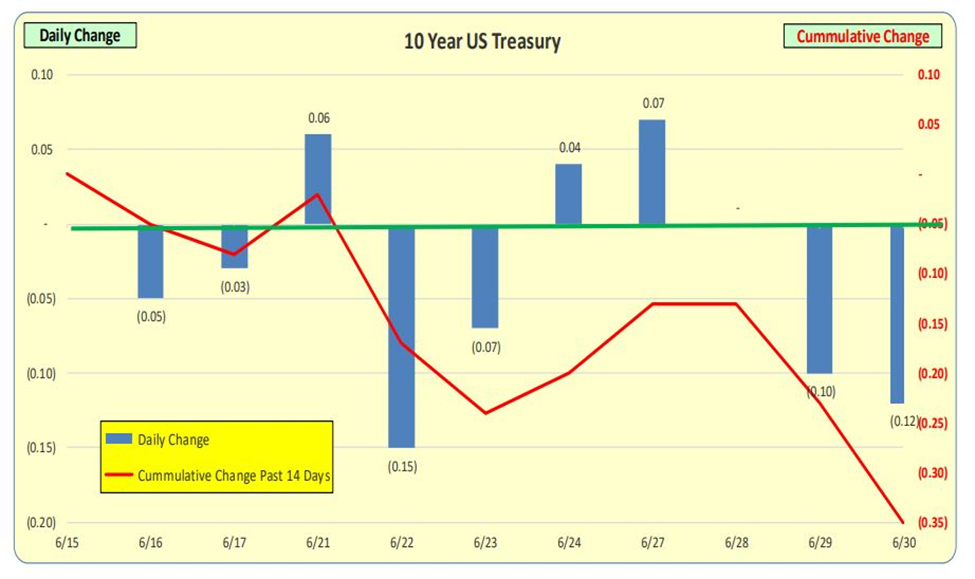

Daily changes in the US 10 Year Treasury rates are the blue bars while the red line is the 14-day cumulative change in rates: 35 bps decrease. RATES ROCKET UP BUT FEATHER DOWN. The blue bars indicate daily changes in rate. It is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

10 Year US Treasury Rates

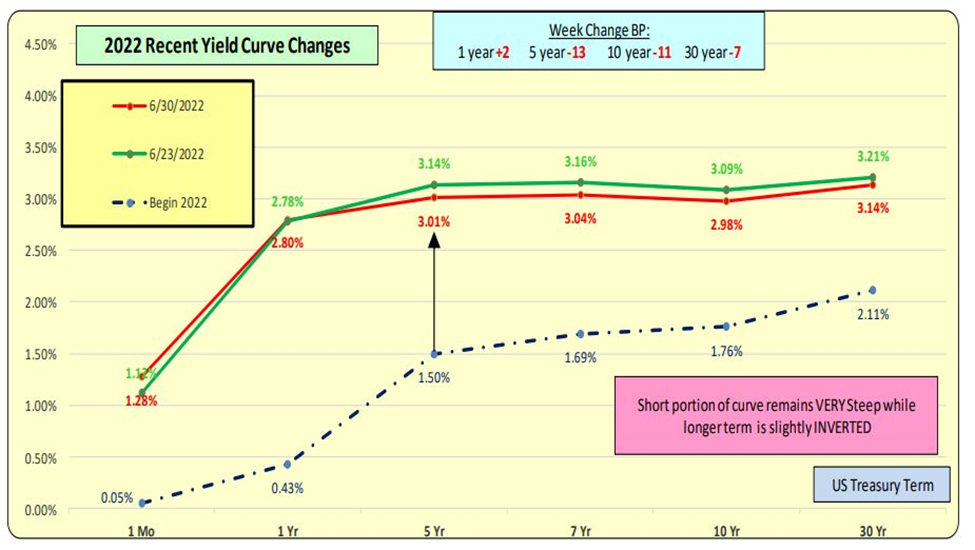

After the Fed increased rates by 75 bps on June 15 rates DECREASED again this past week, particularly for 5 and 10-year terms (red line is current and green is last week). The spread of Mortgage Rates to 10 Years is very high. With 10 years drifting down, mortgage rates may declining but those changes will be cautious. The Yield Curve for short terms is VERY steep while the longer-term (5+) is slightly inverted.

2022 Recent Yield Curve Changes

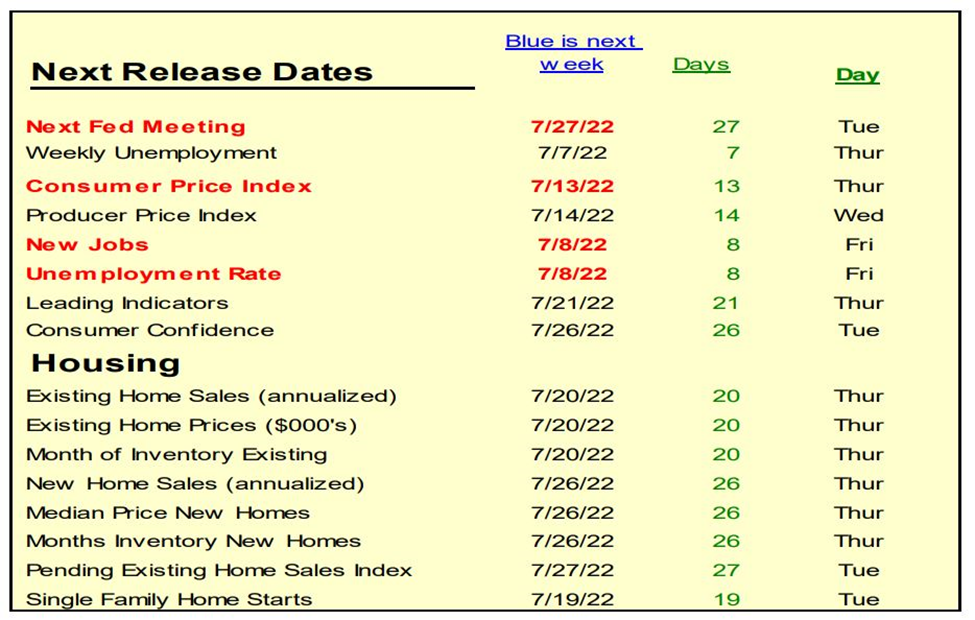

Upcoming week: Monthly Net NEW JOBS and UNEMPLOYMENT RATE……Friday, July 8.

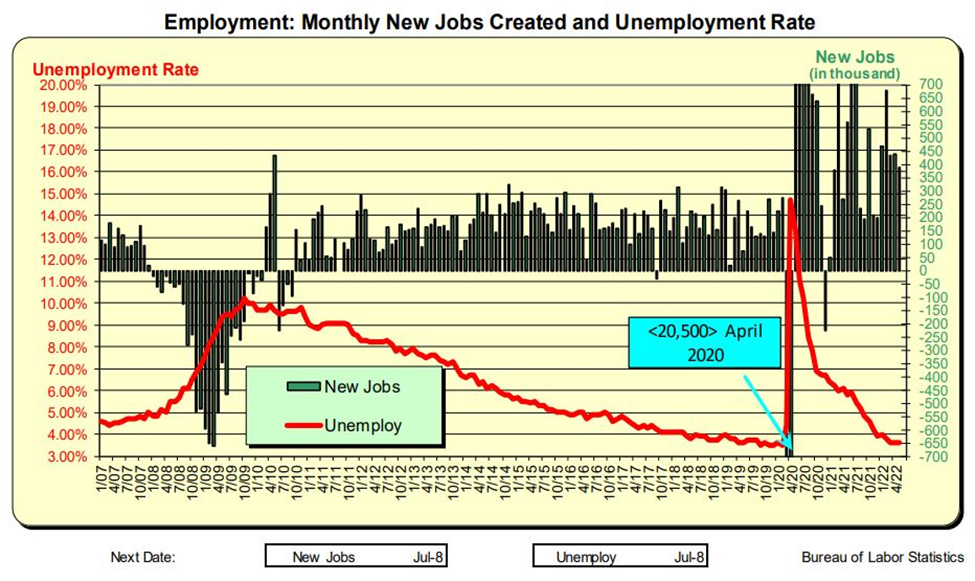

Net New Jobs last month 390,000. Prior to COVID-19, it was 180,000. The current unemployment rate is 3.6%.

New Jobs Created and Unemployment Rate

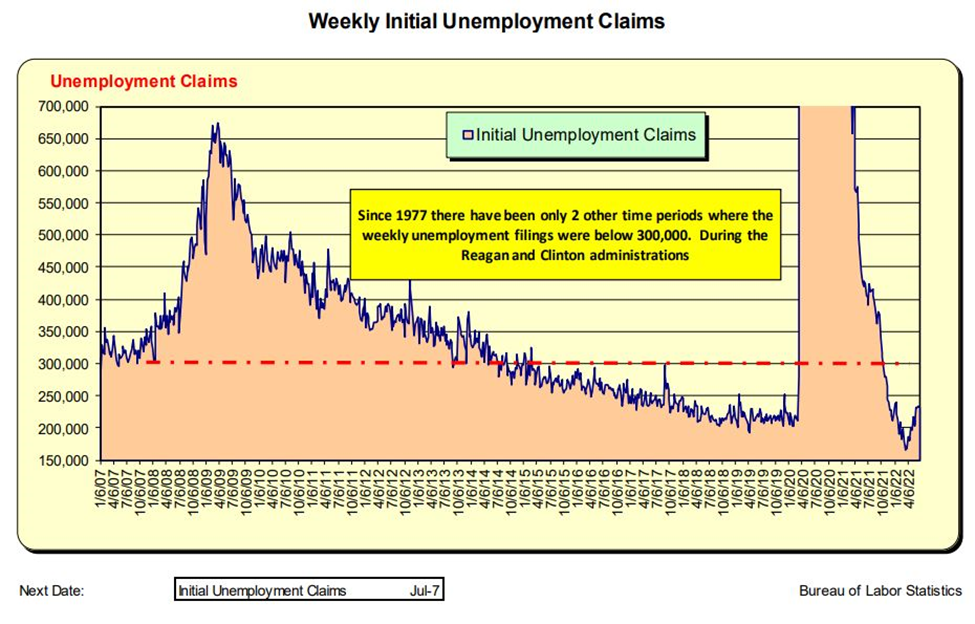

Weekly NEW Unemployment claims have been at record LOWS but have increased over the past few weeks.

Weekly Unemployment Claims

Bill Knudson, Research Analyst Landco ARESC