U.S. Treasury debt, which is the benchmark used to price other domestic debt, is an influential factor in setting consumer interest rates. Yields on corporate, mortgage, and municipal bonds rise and fall with those of the Treasuries, which are debt securities issued by the U.S. government.

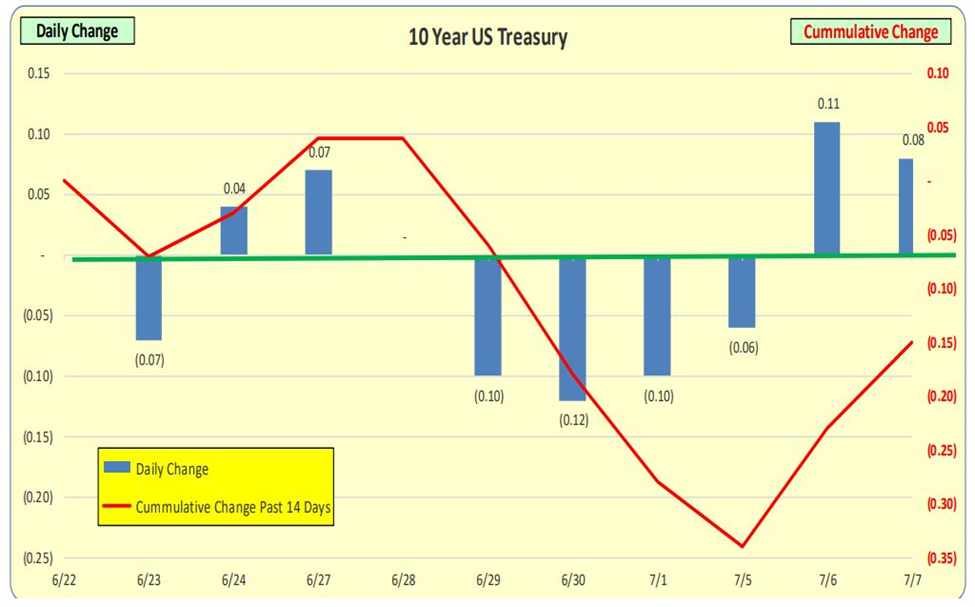

The U.S Treasury yields rose sharply Thursday, extending gains on the 10-year rates by 10 basis points to 3%. But in looking more closely, we see the changes in DAILY rates.

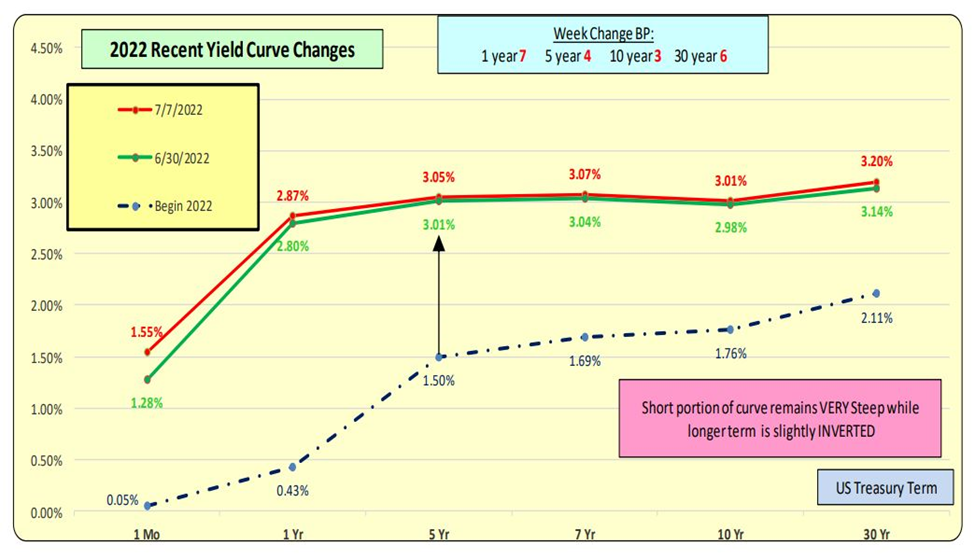

The short-term yield curve remains steep while longer-term 5+ years is slightly INVERTED. With soaring energy costs weakening growth rates, the question is how much higher will the Fed push rates before it has to stop.

Key Econ Items in the upcoming weeks that will/may impact Treasury Rates:

- Monthly Net New Jobs and Unemployment rate 7.8.22

- CPI Inflation 7.13.22

10 Year Treasuries

Note the blue bars; it is unusual to have changes greater than 0.10 in a single day and 0.20 is VERY unusual.

2022 Recent Yield Curve Changes

Except for 1-month rates, changes in the Treasury yield curve for the week were relatively mild considering the substantial decline in mortgage rates. The Yield Curve for short terms is VERY steep while the longer term (5+ years) is slightly inverted.

Economic Release Dates

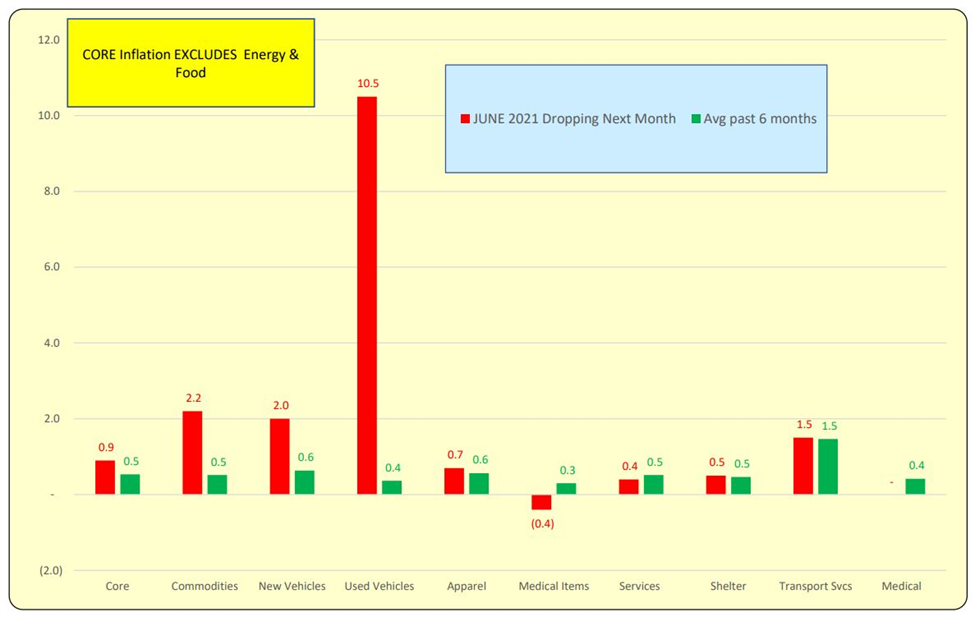

Upcoming Data that May Impact Treasury and Mortgage rates: Monthly Net NEW JOBS and UNEMPLOYMENT RATE as of Friday, July 8. Under 300k will be good for the bond market. CPI inflation is released on July 13. Gas prices for June will be UP while the core inflation data should be down due to the June 2021 used car price spike of 10.5% which will drop off with June 2022 data.

Core Inflation Components

The red bar is June 2021 data that will drop off with the June 2022 data. Green is 2022 average of 6 preceding months of Dec – May 2022. When red is larger than green, that will be an improvement in core inflation.

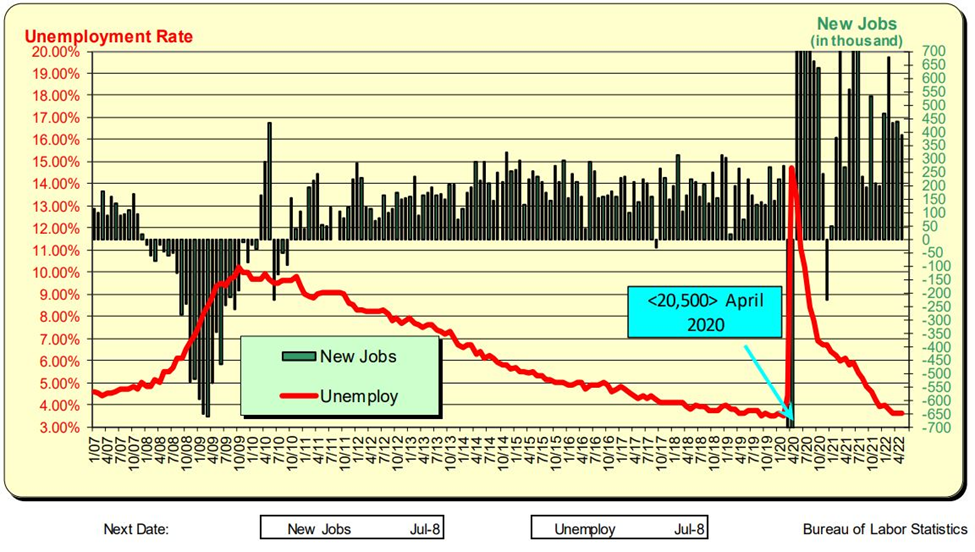

Employment: Monthly New Jobs Created and Unemployment Rate

Net New Jobs last month totaled 390,000. Prior to COVID-19, the total was 180,000. The current unemployment rate is 3.6%. Weekly NEW Unemployment claims have been at record LOWS but have increased over the past few weeks. Interest-rate hikes by the Federal Reserve are expected to cool the demand for workers, however, a release on Wednesday from the government showed US job openings fell slightly in May but remained near a record, while layoffs stayed historically low.

Unemployment Claims

Bill Knudson, Research Analyst Landco ARESC