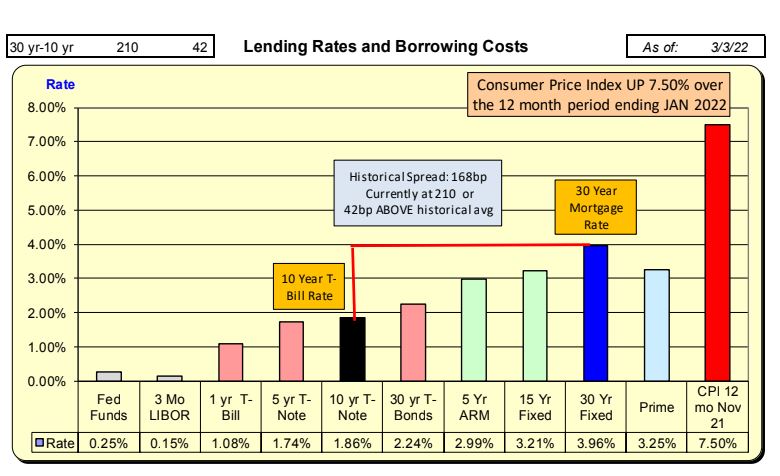

Treasury rates decreased 10 Basis Points as Russia attacked Ukraine. Mid-week Treasuries were off 14 bps while mortgage rates decreased 13 bps for the 7-day period ending 3.3.22. This caused the net spread between the two to decrease 3 bps to 42 bps above the normal spread of 168 bps. It appears the mortgage market is positioned for anticipated rate increases by the Federal Reserve.

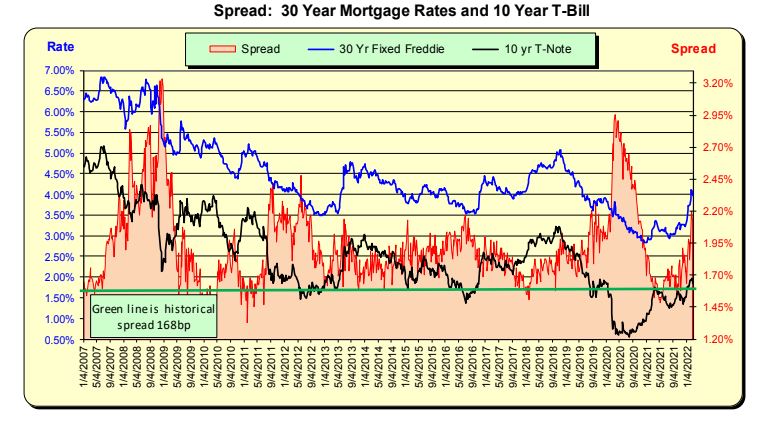

As the 10-Year Treasury rates go, so goes mortgage rates. The green line below is the historic average spread where mortgage rates which is 168 bps ABOVE Treasury. The red line is the actual daily spread. In times of economic crises, the Fed will take action to decrease Treasury rates and it takes some time for mortgage rates to decline—and they do. In an increasing interest rate environment, mortgage rates will rise in anticipation of increases in rates by the Fed—hence the red line will be ABOVE the green average like it is now…