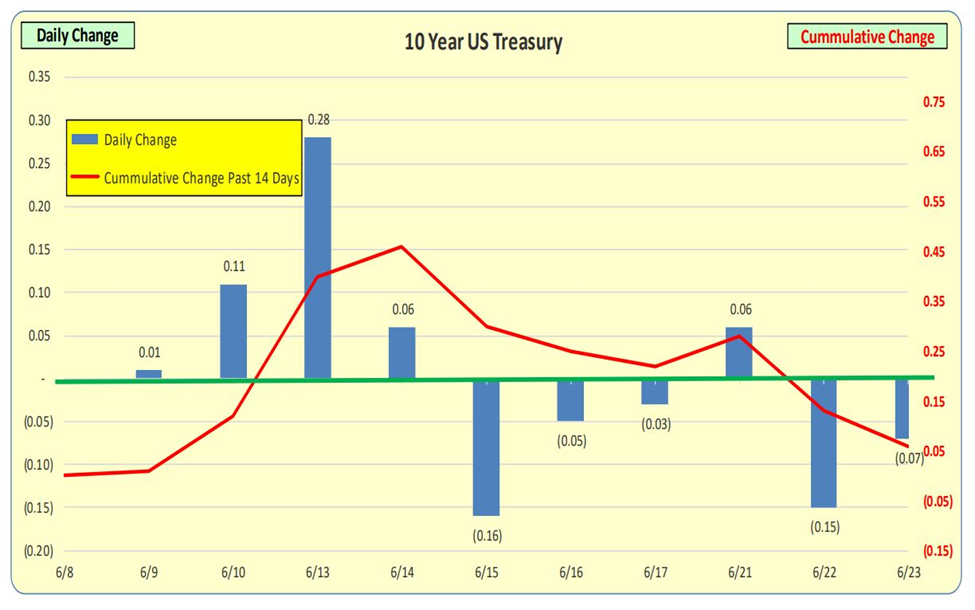

10 Year US Treasury rates DECREASED 19 basis points for the week ending 6.23.22. The short-term yield curve remains steep while longer-term 5+ years is slightly INVERTED.

This occurred a week after the Fed meeting on June, 15th 2022, and their increase of the Federal Fund’s rate by a SUBSTANTIAL 75 bps, reaffirming their determination to combat inflation.

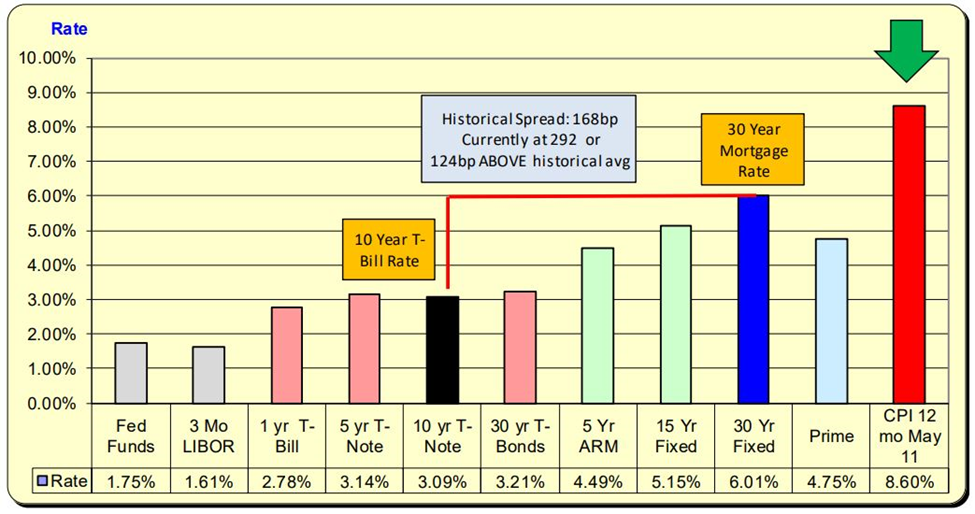

Lending Rates and Borrowing Costs

MORTGAGE RATES remain at 6.01% For the 7-day period ending 6.23.22-, and 10-Year Treasury rates DECREASED by 19 bps. This caused the net spread to increase from 19 bps to 124 bps ABOVE the normal spread of 168 bps.

10 Year US Treasury

Daily changes in the US 10 Year Treasury rates are represented by the blue bars while the red line indicates the 14-day cumulative change in rates which is a 7-bps decrease. RATES ROCKET UP BUT FEATHER DOWN. As presented by the blue bars, it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

Bill Knudson, Research Analyst Landco ARESC