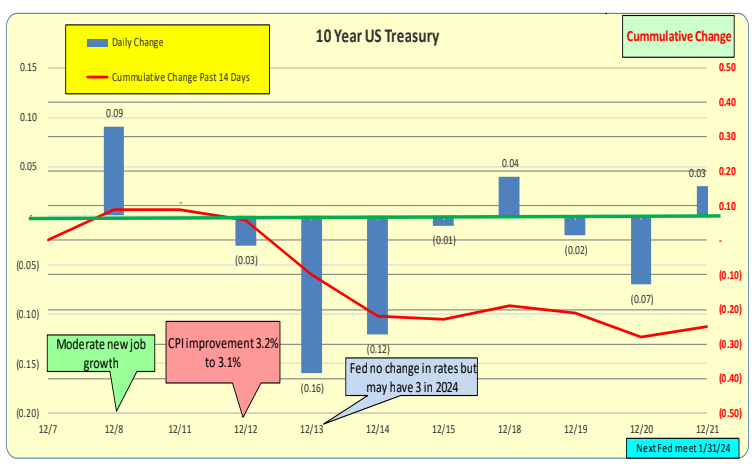

For the past 2 weeks, 10-Year Treasury rates were down 25bp. Past week: down 3bp.

Red line represents the most current rates, while the green line represents rates from one week ago.

Longer-term rates decreased relative to shorter-term rates; as a result, the inverted yield curve is less steep. For terms of 5+ years, the Yield Curve is positive. One-month rates were up 1bp.

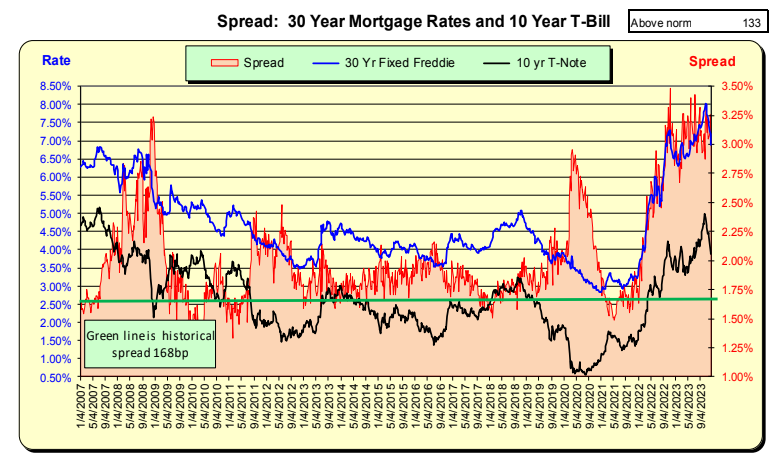

The spread between the 30-year mortgage rate and the 10-year US Treasury rate remains near an all-time high. Mortgage rates fluctuate, rising sharply and then easing. To narrow the spread, either Treasury rates will need to increase, or mortgage rates will need to decrease. Given the Fed’s stance at 1213.23, it appears that Treasury rates will decline in the future, and mortgage rates will likely follow suit. What remains to be seen is the impact of the Fed’s reduction in its Treasury and MBS holdings.

Bill Knudson, Research Analyst LANDCO ARESC