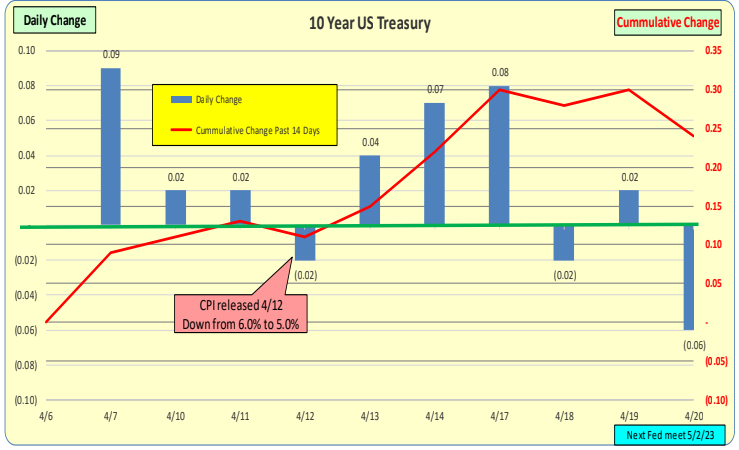

For the past two weeks, the 10-Year Treasury rates have increased by 24bp, with an additional increase of 9bp in the past week. As a result, market swings have been less pronounced.

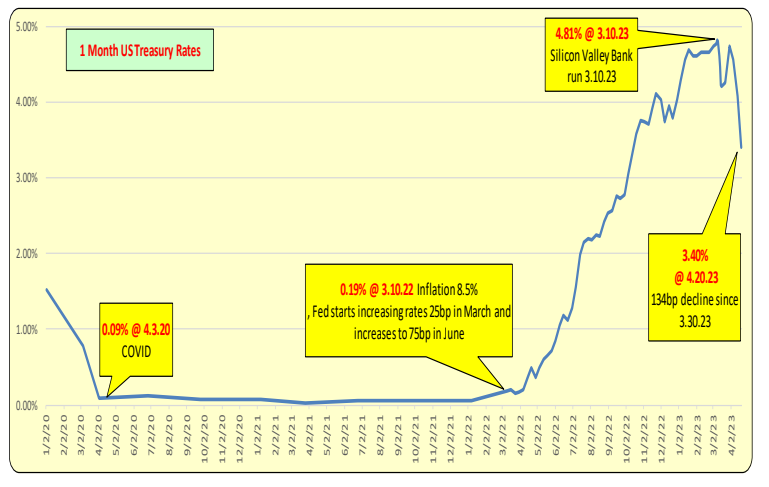

The red line indicates the most current rates, while the green line represents rates from one week ago. The entire yield curve increased by 15bp, but the one-month rate decreased by 68bp. This represents a significant decrease, particularly considering the 49bp drop observed in the prior week. The yield curve remains inverted.

1-Month US Treasuries are in a free fall, with a drop of 134bp over the past three weeks. This may be due to a flight to safety from deposits in excess of $250,000. It’s possible that investors are anticipating the Fed to curtail rate increases and maintain liquidity equity market rebound.