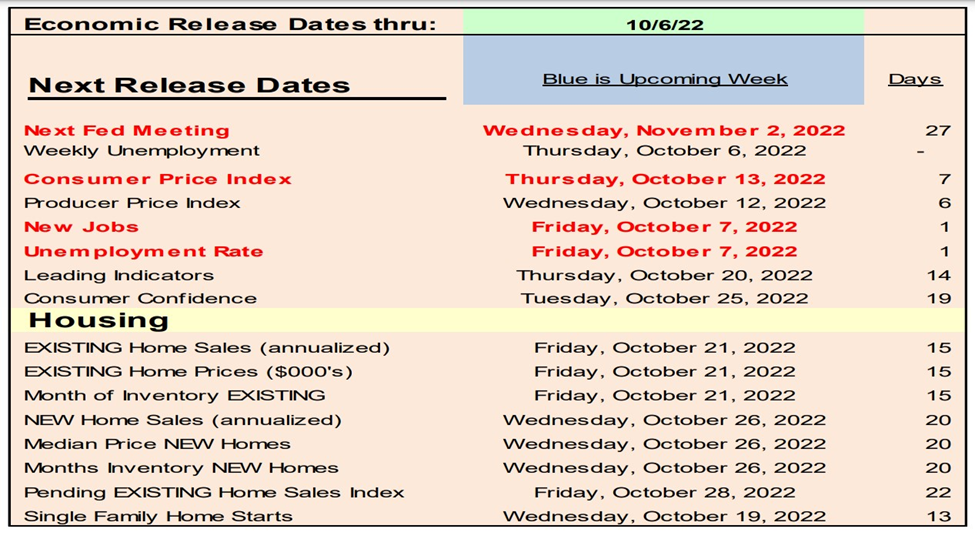

This Week’s Data that Could Impact Treasury and Mortgage Rates are monthly updates and Weekly data on Unemployment Claims–Wednesday and Mortgage rates—Thursday.

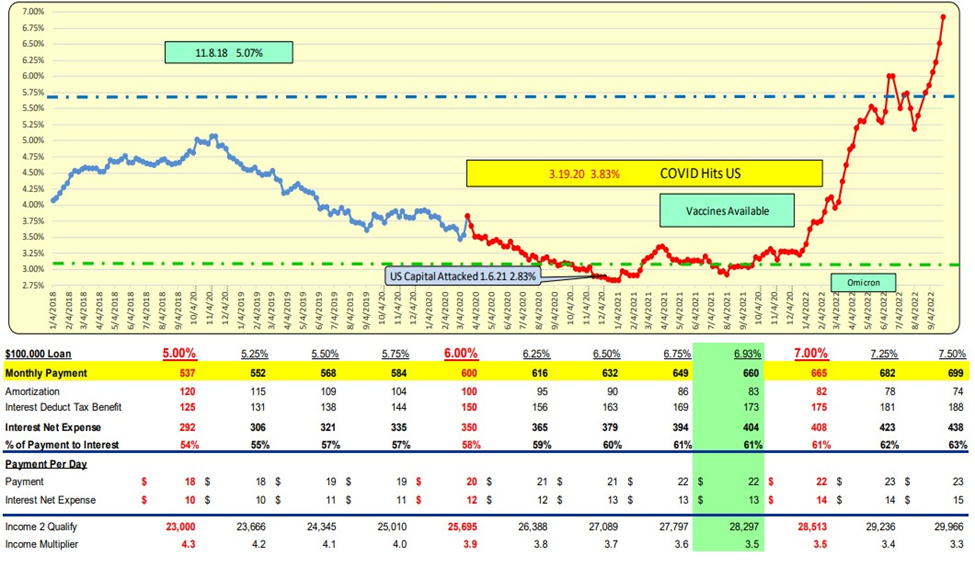

The 10-year Treasury increased by 19 base points on September 26th, 2022, alone. This was followed by a 25 bps decrease on September 28th, 2022. It is believed this decrease was not fully accounted for in the September 29th, 2022, Freddie Mac rate survey.

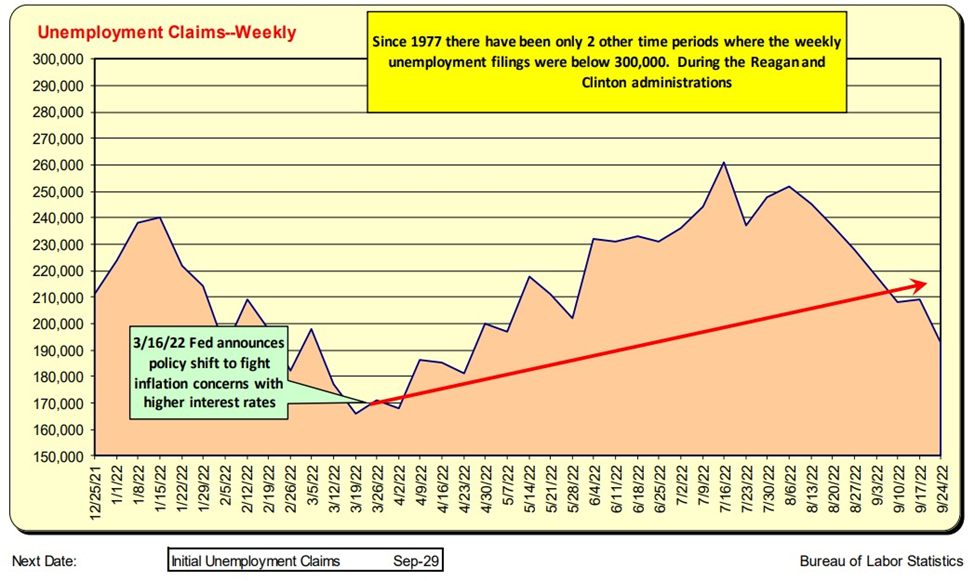

Weekly Initial Unemployment Claims

WEEKLY: Unemployment claims are available each WEDNESDAY. They have been increasing since the Fed announced its intention to increase interest rates to address inflation concerns. As the weekly claim filings increase, it will eventually slow the growth of the MONTHLY Net New Jobs total. Note: Since 1977 there have been only 2 other time periods where the weekly unemployment filings were below 300,000. During the Reagan and Clinton administrations.

30-Year Mortgage Rates

WEEKLY Mortgage rates are available each THURSDAY. Rates have been increasing as the Fed ramps up its efforts to address inflation concerns.

Bill Knudson, Research Analyst Landco ARESC